Shares of Uber Technologies Inc. (NYSE:UBER) surged nearly 6% on Monday after Nvidia Corp. (NASDAQ:NVDA) unveiled its Alpamayo AI platform at CES 2026, a development that Gary Black, Managing Partner of The Future Fund, argues removes a critical risk for the ride-hailing giant.

Democratizing Autonomy

The rally follows Nvidia’s announcement of its Alpamayo family of open-source Vision Language Action (VLA) models, which CEO Jensen Huang described as a “ChatGPT moment” for physical AI.

While the technology promises to bring human-like reasoning to vehicles, Black believes the real winner is Uber’s business model.

According to Black, Nvidia’s strategy to sell a full autonomous stack to original equipment manufacturers (OEMs) like Mercedes and Lucid Group Inc. (NASDAQ:LCID) essentially “democratizes autonomy.”

This allows traditional automakers to deploy self-driving capabilities without needing to build proprietary ride-hailing networks.

Crushing The ‘Obsolescence Risk’

For years, a bear case against Uber has been the threat of “walled gardens.” Investors feared that Tesla Inc. (NASDAQ:TSLA) and Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) Waymo would launch exclusive autonomous ride-hailing services, effectively locking Uber out of the driverless future.

Black argues that Alpamayo neutralizes this threat. By providing a generalized, scalable solution to all automakers, Nvidia creates a fleet of non-Tesla autonomous cars that will likely rely on Uber’s established network for demand.

“The worry was that Waymo and Tesla… would shut Uber out of self-driving,” Black posted on X. Instead, he notes that Nvidia’s tech extends Uber’s asset-light model, allowing it to aggregate self-driving cars from various brands.

Black estimates that removing the driver could eventually cut the cost of an Uber ride by half compared to a chauffeured trip.

Validating The Generalized Approach

The unveiling also serves as validation for Black’s long-standing argument that unsupervised autonomy would not be a winner-take-all market for Tesla.

Nvidia’s platform uses a “vision plus radar” approach that allows OEMs to customize their level of autonomy.

With Mercedes already slated to deploy the tech in the first quarter of 2026, Black contends that the “first-mover advantage” in autonomy is rapidly eroding, securing Uber’s place as the central platform for the autonomous age.

Uber Underperforms Over Last 6 Months

Shares of Uber have declined by 11.52% over the last six months, but risen 29.31% over the year. On Tuesday, the shares rose 5.95% to $85.54 apiece and fell 0.094% after-hours.

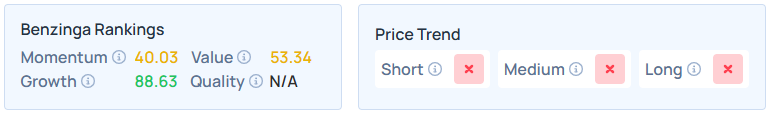

Benzinga’s Edge Stock Rankings indicate that UBER maintains a weaker price trend over the short, medium, and long terms, with a moderate value ranking. Additional performance details are available here.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Recent Comments