Global index provider MSCI decided against excluding cryptocurrency treasury firms from its Global Investable Market Indexes on Monday, significantly boosting shares of companies such as Strategy Inc. (NASDAQ:MSTR) in the after-hours session.

MSCI’s Relief For Crypto-Hoarding Companies

The MSCI announced that the current index treatment of digital asset treasury companies identified in the preliminary list, whose digital asset holdings account for 50% or more of their total assets, will remain unchanged “for the time being.”

The decision was made following a consultation process that raised institutional investors’ concerns that these companies “exhibit characteristics similar to investment funds.”

The consultation feedback also highlighted that such companies might be part of a larger group of entities whose main activities are investment-oriented rather than operational.

MSCI said that the difference between investment companies and other firms holding non-operating assets, such as digital assets, for core operations rather than investment purposes, “requires further research and consultation” with market participants.

‘Strong Outcome For Neutral Indexing’

The development was recognized by Strategy, the world’s biggest cryptocurrency treasury company, and its founder, Michael Saylor.

“A strong outcome for neutral indexing and economic reality. Thank you to our investors and the BTC community,” Strategy said in an X post.

Strategy holds a total of 673,783 BTC, worth a whopping $62.5 billion

Are Crypto Treasury Companies Truly Investment Funds?

Strategy had been vocal about its opposition to MSCI’s proposed 50% digital-asset threshold, describing it as “discriminatory, arbitrary, and unworkable.” The company argued cryptocurrency treasury firms would “whipsaw on and off” major indexes as market prices shift, arguing the rule would generate uncertainty for providers and passive investors.

Strategy also framed the rule as at odds with “pro-innovation policies” of the Trump administration.

JPMorgan analysts estimated that Strategy could face about $2.8 billion in passive outflows if it is removed from major benchmarks. Saylor later described the report as “alarmist.”

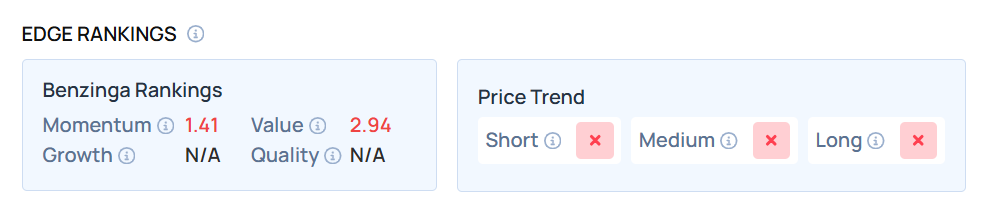

Price Action: Strategy shares rallied 6.60% lower to $168.40 in after-hours trading, according to data from Benzinga Pro. The stock closed 4.10% lower at $157.97 during the regular trading session. MSTR has plunged 58% over the past year.

The stock maintains a weaker price trend over the short, medium and long terms. How does it compare with other Bitcoin-treasury companies? Visit Benzinga Edge Stock Rankings to find out.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Recent Comments