OpenAI is reportedly shifting its first AI hardware project to Foxconn Technology Group, also known as Hon Hai Precision Industry Co., Ltd (OTC:HNHAF), as it accelerates plans to launch a Jony Ive–designed consumer device.

OpenAI Shifts Manufacturing Away From China

OpenAI has moved production of its first AI-powered consumer device from Luxshare to Foxconn, largely due to concerns about manufacturing in mainland China, reported Taiwan-based outlet UDN, citing supply-chain sources.

The device is now expected to be assembled in Vietnam or the U.S., aligning with OpenAI’s preference for a non-China supply chain.

The project, internally known as “Gumdrop,” remains in the design phase, with a commercial launch expected in 2026 or 2027, the report said.

See Also: Apple Scales Back Vision Pro Production, Marketing After Sluggish Sales: Report

Foxconn Expands Role From AI Servers To Consumer Hardware

The shift positions Foxconn as a key partner across OpenAI’s hardware ambitions—from AI servers in the cloud to consumer-facing devices at the edge.

Foxconn already assembles products such as Apple Inc.’s (NASDAQ:AAPL) iPhone and Alphabet Inc.’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Pixel. Landing OpenAI’s hardware orders could add meaningful momentum to its long-term growth.

OpenAI did not immediately respond to Benzinga’s request for comment.

Smart Pen Or Wearable AI Device

The product could take the form of a smart pen or compact audio device, roughly the size of an iPod Shuffle, the report noted, citing sources.

Reports indicate it may feature a microphone and camera to sense its surroundings and support tasks such as handwritten note transcription directly into ChatGPT.

Earlier this year, during a podcast conversation, Altman outlined his vision for an AI companion device, saying the goal is to build “ambiently aware” hardware that could reshape how people engage with technology beyond conventional smartphones.

Altman has hinted that the device will feature a design that is “simple and beautiful and playful.”

Previously, Gene Munster, managing partner at Deepwater Asset Management, said that OpenAI poses Apple’s first meaningful competitive challenge in nearly 20 years after the AI firm’s $6.5 billion purchase of Ive’s hardware startup.

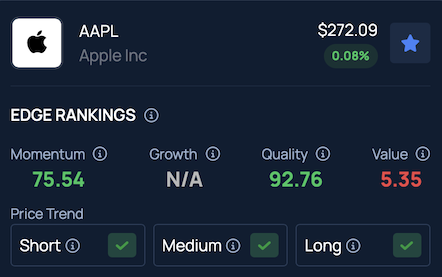

Benzinga Edge Stock Rankings indicate that Apple shares continue to show a solid price trend across the short, medium and long-term, with additional performance metrics available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments