Rocket Lab Corporation (NASDAQ:RKLB) shares are trading marginally lower on Wednesday, pulling back from Tuesday’s move higher. The stock is trading lower as broader markets are experiencing declines, with the S&P 500 down 0.27% and the Nasdaq down 0.31%. Here’s what investors need to know.

Also Read: How Do Investors Really Feel About Rocket Lab Corp?

The Catalyst Driving Recent Momentum

Needham analyst Ryan Koontz recently reiterated a Buy rating on Rocket Lab and raised his price target to $90 from $63, highlighting the company’s emergence as a competitor to SpaceX.

The analyst noted that Rocket Lab’s growing space-systems segment, which supplies satellite buses and components, is contributing to a robust backlog, now totaling approximately $1.4 billion.

The company’s position in the national-security space has strengthened significantly after securing a contract with the Space Development Agency. This contract has more than doubled Rocket Lab’s space-systems backlog, positioning it alongside established players like Lockheed Martin (NYSE:LMT) and L3Harris (NYSE:LHX).

Sector sentiment has strengthened into year-end amid speculation that Elon Musk’s SpaceX may pursue an initial public offering in 2026 at a valuation approaching $1.5 trillion.

Technical Analysis Shows Underlying Strength

Rocket Lab is currently trading 16.1% above its 20-day simple moving average (SMA) and 32.1% above its 100-day SMA, indicating strong short-term momentum. Over the past 12 months, shares have surged 175.93%, and the stock is currently positioned closer to its 52-week highs than lows.

The RSI stands at 62.41, which is considered neutral territory, while the MACD is above its signal line, indicating bullish momentum. The combination of these indicators suggests that the stock is in a favorable position for continued upward movement.

- Key Resistance: $74.00

- Key Support: $58.50

EXCLUSIVE: UFO Vs. ARKX Space ETF Battle Reveals ‘Only Pure Play’ Bet on Sector

Earnings & Analyst Outlook

Investors are starting to look ahead to the company’s next earnings report in February 2026.

- EPS Estimate: Loss of 9 cents (Improved from a loss of 10 cents YoY)

- Revenue Estimate: $177.85 million (Up from $132.39 million YoY)

- Analyst Consensus: Buy Rating ($53.23 Avg Price Target)

Note: The average price target suggests the stock is trading at a premium to analyst targets.

Top ETF Exposure

- SPDR S&P Aerospace & Defense ETF (NYSE:XAR): 5.66% Weight

- ARK Space Exploration & Innovation ETF (NASDAQ:ARKX): 7.62% Weight

- ARK Space & Defense Innovation ETF (NASDAQ:ARKX): 7.62% Weight

With significant weighting across these ETFs, the stock’s performance can impact investors tracking these funds, making it important for ETF investors to monitor the company’s moves.

RKLB Price Action

Rocket Lab shares were down 1.22% at $69.58 at the time of publication on Wednesday, according to Benzinga Pro data.

Benzinga Edge Rankings

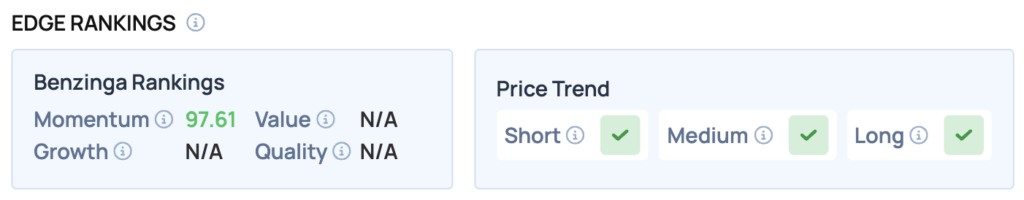

Benzinga Edge data shows Rocket Lab with a Momentum score of 97.61, alongside positive short-, medium- and long-term price trends, underscoring strong technical strength relative to peers.

Read Also: Applied Digital Stock In Focus: Fresh Analyst Coverage With Earnings Around The Corner

Image: Shutterstock

Recent Comments