As of Dec. 31, 2025, two stocks in the financial sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

UBS Group AG (NYSE:UBS)

- On Dec. 16, B of A Securities analyst Antonio Reale upgraded UBS from Neutral to Buy and raised the price target from $44 to $60.3. The company’s stock gained around 21% over the past month and has a 52-week high of $47.30.

- RSI Value: 75.5

- UBS Price Action: Shares of UBS slipped 0.1% to close at $46.52 on Tuesday.

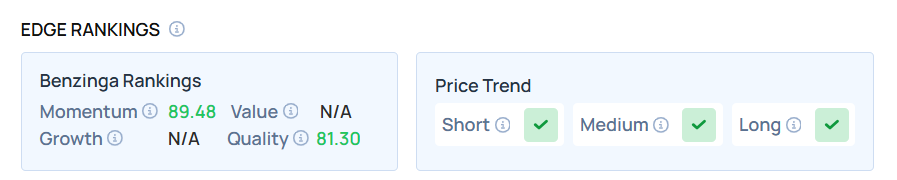

- Edge Stock Ratings: 89.48 Momentum score.

Assurant Inc (NYSE:AIZ)

- On Nov. 4, Assurant reported better-than-expected third-quarter financial results. “Supported by our strong third quarter results, our year-to-date outperformance illustrates the strength of Assurant with earnings growth contributions from Global Housing and across Connected Living and Global Automotive within Global Lifestyle. Our financial performance further reinforces the importance of the disciplined execution of our strategy to drive momentum through continuous innovation, exceptional customer experiences and commercial success,” said Assurant President and CEO Keith Demmings. The company’s stock gained around 7% over the past month and has a 52-week high of $243.76.

- RSI Value: 74.5

- AIZ Price Action: Shares of Assurant gained 0.3% to close at $242.13 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments