Plug Power Inc (NASDAQ:PLUG) shares are trading higher Wednesday, up roughly 5% for December but still down 13% year-to-date, capping a volatile year as investors weighed its role in supplying clean power for AI-era energy demand.

The stock is gaining early Wednesday after Clear Street analyst Tim Moore upgraded Plug Power from Hold to Buy, but lowered the price target from $3.50 to $3.00. Here’s what investors need to know.

- Plug Power shares are advancing steadily. What’s pushing PLUG stock higher?

How Plug Power Is Transforming Green Energy Dynamics

The recent movement in Plug shares can be traced back to Dec. 5, when shares firmed after Plug announced a 5-megawatt PEM electrolyzer sale to Hy2gen’s Sunrhyse project in France and its first liquid-hydrogen contract with NASA’s Glenn Research Center, alongside a $431.25 million convertible note deal to refinance 15% debt and target positive EBITDA by late 2026.

On Dec. 9, shares rallied as CEO Andy Marsh hailed the financing as a “major turning point,” with the lower interest burden expected to save about $20 million annually and positioning the company to benefit if Fed rate cuts reduce its cost of capital.

On Dec. 17, Plug said it had installed a 5-MW GenEco electrolyzer for the Cleanergy Solutions Namibia project, backing Africa’s first fully integrated commercial green-hydrogen facility to fuel trucks, port equipment and small vessels at Walvis Bay.

A day later, on Dec. 18, the stock jumped after peer FuelCell Energy Inc posted strong results, reinforcing optimism that green hydrogen is edging toward commercialization.

Is AI Demand Fueling Plug Power’s Stock Surge?

Plug is seen as an AI play because its electrolyzers and fuel-cell systems can provide low-carbon, on-site backup and balancing power for energy-hungry data centers running AI workloads.

As hyperscalers hunt for ways to decarbonize always-on GPU farms, any traction Plug gains with these customers could link its growth directly to the AI build-out.

Benzinga Edge Rankings

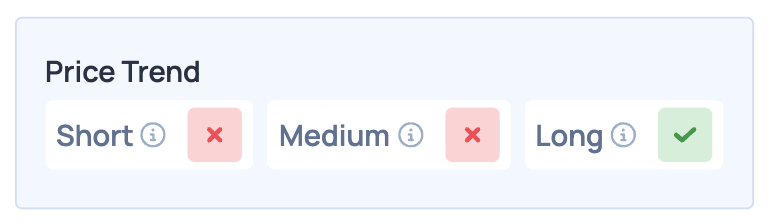

Despite near-term volatility, Plug Power earns a bullish long-term price trend score from Benzinga Edge Rankings while its short- and medium-term trends remain negative, underscoring the stock’s high volatility but longer-horizon upside potential.

Plug Power Stock Climbs In Early Trading

PLUG Price Action: Plug Power shares were up 2.58% at $1.99 at the time of publication on Wednesday, according to Benzinga Pro data.

Plug Power has experienced considerable volatility over the past year, with a 52-week range spanning from $0.69 to $4.58. This wide range highlights the stock’s susceptibility to market fluctuations and investor sentiment, which can be influenced by broader trends in the renewable energy sector.

Image: Shutterstock

Recent Comments