Micron Technology Inc (NASDAQ:MU) shares are trading slightly lower Wednesday morning as investors take profits following a blistering year-to-date rally of roughly 230%. Here’s what investors need to know.

- Micron Technology shares are experiencing downward pressure. What’s driving MU stock lower?

Fresh Record Run In 2025

Micron shares have surged more than $200 this year, lifting the stock from the mid-$80s in January to new 52-week highs this month. Shares traded as high as $298.83 before pulling back.

The run-up has boosted Micron’s market capitalization to about $325 billion and pushed its trailing price-to-earnings ratio to roughly 27 times, levels that underscore investor belief that the memory maker will be a key player in the artificial intelligence boom.

Analyst Ratings

Wall Street remains broadly bullish on Micron following its latest results, with JPMorgan, KeyBanc and Cantor all reiterating Overweight calls, Needham and Rosenblatt sticking with Buy ratings and Wedbush keeping an Outperform, while Goldman Sachs maintains a Neutral stance but still expects the shares to grind higher.

Price targets have been lifted sharply into the low-to-mid $300s, led by JPMorgan and Cantor at $350, KeyBanc at $325 and Needham at $300, while Rosenblatt has set a Street-high $500 target based on a view that Micron can earn about $36 a share in fiscal 2027 and remains a key beneficiary of AI-driven memory demand.

Analysts highlight robust DRAM and NAND pricing, continued high-bandwidth memory (HBM) momentum and a multi-year supercycle in AI and data-center spending.

Read Also: China Mandates 50% Domestic Gear For New Chip Capacity

Earnings and Outlook

Micron’s first-quarter report delivered revenue of $13.64 billion and adjusted earnings of $4.78 per share, results that beat Wall Street estimates and underpinned the stock’s powerful breakout.

Management followed the beat with strong guidance, projecting second-quarter revenue of about $18.7 billion and telling investors it expects record revenue and margins in fiscal 2026.

Micron also framed the current upturn as structurally different, forecasting the HBM market to expand from roughly $35 billion in 2025 to $100 billion by 2028, and several analysts noted that the company is accelerating toward mid-70s gross margins while the stock still trades below what they view as typical peak-earnings multiples.

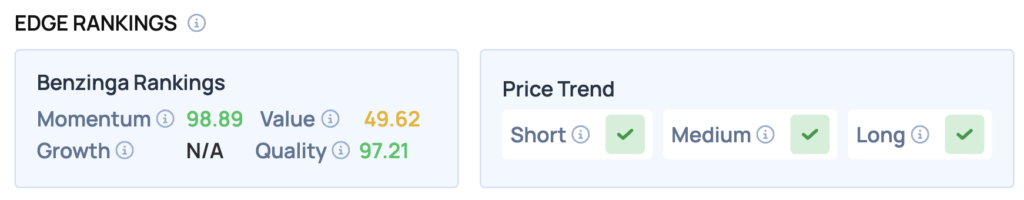

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, which provide four critical scores to help you identify the strongest and weakest stocks to buy and sell, Micron boasts a standout 98.89 Momentum score alongside a 97.21 Quality score.

MU Price Action: Micron Technology shares were down 1.84% at $287.25 at the time of publication on Wednesday. The stock is trading near its 52-week high of $298.83, according to Benzinga Pro data.

Key support levels can be identified around $284, where the stock found a low during the trading session. If this level holds, it could provide a foundation for a rebound.

Conversely, resistance remains strong near the 52-week high of $298.83, which may act as a psychological barrier for traders looking to push the stock higher.

EXCLUSIVE: Trump’s Moves Added To 2025’s Crypto Overload — Now 2026 Looks Rough, Expert Says

Image: Shutterstock

Recent Comments