Investor Michael Burry is raising concerns regarding Tesla Inc.’s (NASDAQ:TSLA) valuations, especially considering its decelerating sales momentum.

Tesla Is ‘Ridiculously’ Overvalued

On Tuesday, in a post on X, Burry said, “Tesla is ridiculously overvalued,” after the company shared consensus estimates of its fourth-quarter vehicle sales on Monday, with projected figures coming in below investor expectations.

The company compiled estimates from across several prominent sell-side analysts, arriving at a broad consensus of 422,850 units for the current quarter, which is 14.93% below the prior quarter, and down 15% compared to the same period last year.

See Also: Tesla’s Real Value Is In Physical AI – Not Car Deliveries, Munster Warns

As a result, Tesla is headed for its second consecutive drop in annual vehicle sales, with average estimates at 1,640,752 units, down 8.8%, compared to just under 1.8 million global deliveries in 2024.

Yet, the company remains the most valuable automaker in the world, with a market capitalization of $1.53 trillion, while trading at 204 times forward earnings, which is many times over the industry’s average price-to-earnings ratio of 17.47.

Burry, who rose to fame for betting against the housing market ahead of the 2008 financial crisis, has been a vocal critic of Tesla’s valuation in recent weeks.

He made the same statement in his newsletter earlier this month, while also highlighting CEO Elon Musk’s trillion-dollar pay package, which he warned would lead to stock dilution. He said that the company dilutes its shareholders by 3.6% annually, without any corresponding stock buybacks.

“As an aside, the Elon cult was all-in on electric cars until competition showed up, then all-in on autonomous driving until competition showed up, and now is all-in on robots — until competition shows up,” Burry said. He, however, noted that he does not have a short position against the company right now.

This Is ‘Very Unusual’ For Tesla

Fund manager and prominent Tesla analyst Gary Black said in a post on X that it was “very unusual” for Tesla to issue a press release with the quarterly sell-side consensus estimates.

“Obviously, someone at TSLA wanted the IR-derived consensus to be distributed as widely as possible,” he said, while adding that he expects the company’s fourth-quarter deliveries to be in the “420K range than the 445K range.”

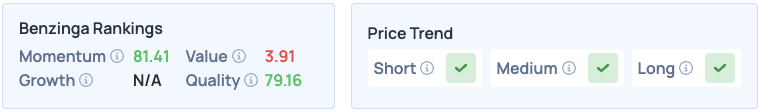

Tesla shares were down 1.17% on Tuesday, closing at $454.24, and are down 0.35% overnight. The stock scores high on Momentum and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo Courtesy: Tada Images on Shutterstock.com

Read More:

Recent Comments