Warner Bros. Discovery (NASDAQ:WBD) is reportedly likely to turn down Paramount Skydance’s (NASDAQ:PSKY) sweetened hostile bid even after billionaire Larry Ellison stepped in with a personal guarantee.

Warner Bros Board Unconvinced By Sweetened Paramount Offer

Warner Bros. Discovery’s board is expected to reject Paramount Skydance’s amended $108.4 billion takeover proposal, reported Reuters, citing a person familiar with the matter.

The board has not made a final decision but is expected to meet next week to discuss the bid.

Paramount, led by CEO David Ellison, sought to bolster confidence by having his father, Oracle Corp (NYSE:ORCL) founder Larry Ellison, personally guarantee the equity portion of the deal.

Still, the company did not raise its $30-per-share all-cash offer, instead extending its tender deadline and increasing its regulatory reverse termination fee.

Warner Bros. Discovery and Paramount did not immediately respond to Benzinga’s request for comments.

See Also: AMC Entertainment Stock Hits A New All-Time Low: What’s Going On?

Netflix Deal Seen As Lower Risk Path

The likely rejection would keep Warner Bros. on track to pursue a competing cash-and-stock deal with Netflix Inc. (NASDAQ:NFLX) valued at about $82.7 billion.

While lower in headline value, analysts have said the Netflix offer provides clearer financing and fewer execution risks, the report said.

Under the Netflix agreement, Warner Bros. would owe a $2.8 billion breakup fee if it walks away. Harris Oakmark, Warner Bros.’ fifth-largest shareholder, said Paramount’s revised proposal was not sufficient and would not fully offset that penalty.

Regulatory And Political Risks Loom

Paramount has argued its bid would face fewer regulatory hurdles and create a media giant larger than Walt Disney Co. (NYSE:DIS) by combining two major Hollywood studios and television operators.

Warner Bros.’ board previously urged shareholders to reject Paramount’s bid, citing financing uncertainty and insufficient guarantees.

Concerns over media consolidation remain high, with lawmakers from both parties raising objections. President Donald Trump has also said he plans to weigh in on the potential acquisition.

However, Sen. Elizabeth Warren (D-Mass.) warned that the Justice Department’s review of rival takeover bids for Warner Bros. Discovery could be influenced by political favoritism.

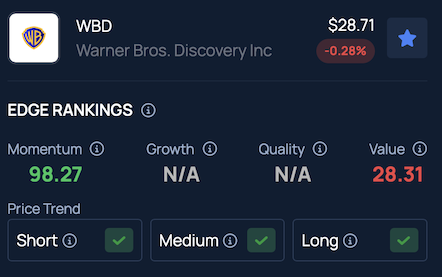

Price Action: In after-hours trading, Netflix shares are down 0.30%, Paramount shares slipped 0.074% and Warner Bros. Discovery declined by 0.78%, according to Benzinga Pro.

Benzinga Edge Stock Rankings show Warner Bros. Discovery posting a strong price trend in the short, medium and long term, with more detailed performance metrics available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: T. Schneider via Shutterstock

Recent Comments