After a year dominated by mega-cap winners and AI bellwethers, several notable stocks were left behind in 2025, quietly positioning themselves to lead in the new year at valuations that remain reasonable relative to their industry peers.

Below is a list of the top AI or AI-adjacent stocks that, according to leading analysts and experts, are all set to soar in 2026, after a largely underwhelming performance in 2025.

1. Apple Inc.

While by no means an underdog, tech giant Apple Inc. (NASDAQ:AAPL) has trailed its “Mag 7” peers, tracked by the Roundhill Magnificent Seven ETF (BATS:MAGS) over the past year, with year-to-date gains of just 12.12%, compared with the ETF’s 25.54%.

This was primarily due to it lagging behind its peers in the AI race, along with significant trade and tariff-related headwinds it faced this year.

See Also: Top AI Infrastructure Stocks For 2026 Industrial Super-Cycle

Analyst and Managing Partner at Deepwater Asset Management, Gene Munster, said in his 2026 predictions newsletter earlier this month that the company is poised for a turnaround in 2026, adding that “Apple will be the best performing Mag 7 stock” during the first six months.

Munster attributed this to iPhone sales “exceeding expectations in the December and March quarters,” and to the launch of the new Siri, which he said would occur before April 30 of the following year.

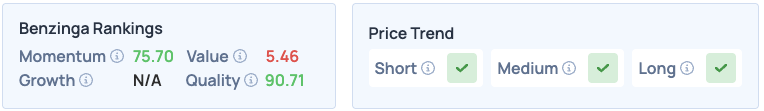

Apple shares score high on Momentum and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here to see how it compares with its “Mag 7” peers.

2. Adobe Inc.

Despite being a prominent AI play, Adobe Inc. (NASDAQ:ADBE) has underperformed against its AI peers over the past year and is currently down 19.77% year-to-date.

The company is, however, seeing strong traction with its AI tools, such as Firefly, with generative AI credit usage across its product ecosystem jumping 3x over the past quarter.

Analysts at JPMorgan Chase have highlighted the “stickiness” of Adobe’s product ecosystem and reiterated their “Overweight” rating on the stock, with a Price target of $520 per share, representing a 46.97% upside from current levels.

Independent analyst Parkev Tatevosian, CFA, on his YouTube channel, pegged the stock’s fair value at $460 per share, or an upside of 30% from current levels, highlighting that the stock currently trades at just 15 times forward earnings, its lowest level in “many, many years.”

Shares of Adobe score poorly on Momentum and Value in Benzinga’s Edge Stock Rankings, but have a favorable price trend in the short and medium terms. Click here for deeper insights into the stock, its peers and competitors.

3. Palo Alto Networks Inc.

Senior analyst, Dan Ives of Wedbush Securities, said last week that 2026 will be the year when “cybersecurity meets AI,” while highlighting stocks such as Palo Alto Networks Inc. (NASDAQ:PANW) and CrowdStrike Holdings Inc. (NASDAQ:CRWD) as key beneficiaries of this trend, while appearing on CNBC’s “Power Lunch.”

Unlike CrowdStrike, however, Palo Alto’s performance this past year has been underwhelming, up just 4.27% year-to-date. Still, Ives expects the stock, along with the rest of this sector, to ride the growing “AI and cybersecurity” wave in the new year.

Morgan Stanley has echoed Ives’ views on the company, naming it as one of its top picks for 2026. Analyst Meta Marshall called it the “best idea for 2026,” while adding that the stock was “too attractive to ignore at current prices,” according to a report by CNBC.

Despite its muted performance this year, Palo Alto trades at a fairly expensive 49 times forward earnings, yet analysts remain bullish, with a consensus price target of $225.32 per share, representing 19.56% upside from current levels.

Palo Alto Networks does poorly on Momentum and Value in Benzinga’s Edge Stock Rankings, but does well on Growth. It features an unfavorable price trend in the short, medium and long terms. Click here to see how the stock compares against CrowdStrike, along with its other peers and competitors.

4. Airbnb Inc.

Vacation rental platform, Airbnb Inc. (NASDAQ:ABNB) has had a fairly lackluster year, with year-to-date gains of just 4.06%, following a string of mixed earnings performances in recent quarters, alongside growing investments, without demonstrating any traction across new services and initiatives.

Analysts expect the company to turn a corner in 2026, with Brad Erickson of RBC Capital Markets calling it an “increasingly attractive brand monetization story” earlier this month.

While upgrading the stock’s rating to “Outperform” and raising its Price Target to $170 from $145, representing an upside of 24.25% from current levels, Erickson noted that the company has strong first-party data, which will be highly valued in the “evolving consumer AI landscape.”

Other reasons mentioned in the research note include its foray into hotel bookings, alongside short-term tailwinds from the Milan Olympics and the FIFA World Cup next year.

Shares of Airbnb do poorly on Momentum, Growth and Value in Benzinga’s Edge Stock Rankings, but have a favorable price trend in the short, medium and long terms. Click here to see how they perform against other hotel and hospitality stocks.

5. Target Corp.

Retail giant Target Corp. (NYSE:TGT) has had a rough 2025, with the stock down 27.44% year-to-date, owing to a decline in foot traffic, alongside the tariffs and inflationary pressures that weighed on its core consumers.

The company is currently in the midst of major changes, with COO Michael Fiddelke set to take over as CEO from February 1, 2026. Apart from this, it is currently working to tariff-proof its supply chains, with plans to bring its Chinese imports down to 25% the coming year, from 60% in 2017.

The Minnesota-based retailer is leaning deeper into AI, with an expanded partnership with ChatGPT-parent OpenAI, aimed at unlocking significant value and efficiencies across its shopping aisles. This makes the century-old brick-and-mortar retailer a significant AI play, not unlike the others on this list.

The stock currently trades at just 12.76 times forward earnings, compared to Walmart Inc. (NASDAQ:WMT) and Costco Wholesale Corp. (NASDAQ:COST) at 36.76 and 46.73, respectively.

Recently, Telsey Advisory Group analyst Joseph Feldman reiterated the “Market Perform” rating on the stock, with a price forecast of $110, which is an upside of 10.49% from current levels.

Besides this, activist hedge fund Tom Capital Investment Management disclosed a sizable stake in the retailer last week, sparking a rally in the stock, a move widely viewed as a catalyst for unlocking shareholder value.

Target scores highly on Value in Benzinga’s Edge Stock Rankings but performs poorly on Momentum and Quality. The stock has a favorable price trend in the short and medium terms. Click here for deeper insights into the stock, its peers and competitors.

Photo Courtesy: yanadhorn on Shutterstock.com

Read More:

Recent Comments