The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Best Buy Co Inc (NYSE:BBY)

- On Nov. 25, Best Buy reported better-than-expected third-quarter financial results and raised its FY26 guidance. “We are pleased to report better-than-expected sales and adjusted operating income rate for the third quarter,” said Corie Barry, Best Buy CEO. “Our comparable sales grew 2.7% as we continued to drive strong results across computing, gaming and mobile phones. We delivered sales growth across both online and stores, saw continued improvements in customer experience ratings and launched our Best Buy Marketplace.” The company’s stock fell around 12% over the past month and has a 52-week low of $54.99.

- RSI Value: 24.4

- BBY Price Action: Shares of Best Buy fell 2.5% to close at $67.84 on Monday.

- Edge Stock Ratings: 91.92 Momentum score with Value at 93.51.

Harley-Davidson Inc (NYSE:HOG)

- On Dec. 10, Harley-Davidson named Jonathan Root as CFO and CCO, while Bryan Niketh was named COO. “As we reimagine our future, we are returning to what makes Harley-Davidson uniquely powerful,” said Artie Starrs, President and CEO, Harley-Davidson. “These changes set us up to deepen our connection to riders and dealers, accelerate data-led and tech-enabled engagement, and unlock the full potential of our operations.” The company’s stock fell around 14% over the past month and has a 52-week low of $20.45.

- RSI Value: 27.9

- HOG Price Action: Shares of Harley-Davidson fell 0.9% to close at $20.82 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in HOG stock.

Advance Auto Parts Inc (NYSE:AAP)

- On Dec. 16, Evercore ISI Group analyst Greg Melich maintained Advance Auto Parts with an In-Line rating and lowered the price target from $58 to $56. The company’s stock fell around 25% over the past month and has a 52-week low of $28.89.

- RSI Value: 29.2

- AAP Price Action: Shares of Advance Auto Parts fell 3.4% to close at $39.87 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in AAP shares.

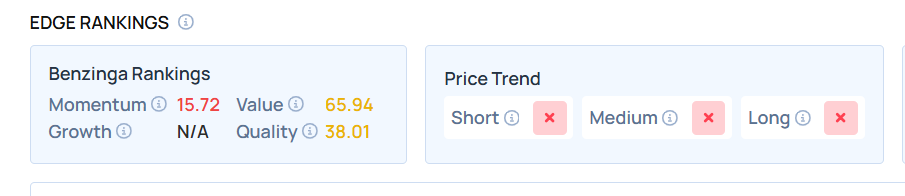

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments