As of Dec. 30, 2025, two stocks in the energy sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Tetra Technologies Inc (NYSE:TTI)

- On Dec. 11, CJS Securities analyst Jonathan Tanwanteng initiated coverage on Tetra Technologies with an Outperform rating and announced a price target of $11.5. The company’s stock gained around 22% over the past month and has a 52-week high of $9.53.

- RSI Value: 70.7

- TTI Price Action: Shares of Tetra Technologies rose 0.6% to close at $9.40 on Monday.

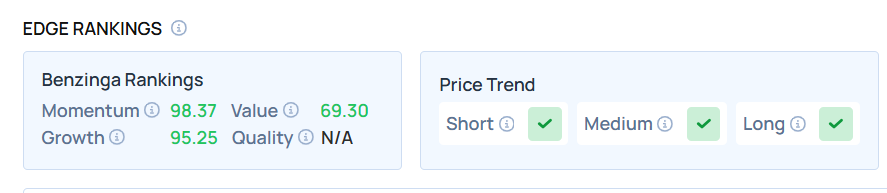

- Edge Stock Ratings: 98.37 Momentum score with Value at 69.30.

Gulf Island Fabrication Inc (NASDAQ:GIFI)

- On Nov. 12, Gulf Island Fabrication posted mixed third-quarter results. “We delivered strong third-quarter results with revenue of $51.5 million and adjusted EBITDA of $2.5 million, despite softer trends in our services business, a decline in small-scale fabrication activity and anticipated losses from our recently acquired Englobal business,” stated Richard Heo, Gulf Island’s Chief Executive Officer. The company’s stock gained around 14% over the past five days and has a 52-week high of $12.00.

- RSI Value: 84.9

- GIFI Price Action: Shares of Gulf Island Fabrication closed at $11.94 on Monday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

Recent Comments