Silver has quietly delivered one of the most explosive performances in global markets this year, rallying 152% year-to-date, marking its strongest annual performance since 1978, effectively stealing the spotlight from gold, which is up 66.22% so far this year.

Both precious metals touched record highs last week, with silver soaring past $82 per ounce, before witnessing a steep 14% decline on Monday.

What’s Driving Silver’s Record Rally?

Unlike gold, silver is more than just a store of wealth or a hedge against inflation. It also serves several industrial and commercial use cases, making it a truly unique market.

So while the initial rally was sparked by the broad-based shift toward hard assets in response to President Donald Trump’s tariffs, trade wars and other unorthodox economic policies, the commodity also witnessed strong tailwinds from a supply crunch amid soaring industrial demand.

Earlier this year, Maria Smirnova, a portfolio manager at Sprott Asset Management, said that the commodity’s rally was only just getting started due to the shrinking supply, potentially giving rise to a price squeeze.

“The available inventory of freely traded silver has been heavily diminished, making the metal more sensitive to incremental buying,” she said, adding that even “small increases in demand could now lead to disproportionately large increases in price.”

According to Sprott, the global silver market is headed toward its seventh consecutive year of deficit in 2025, with the cumulative shortfall since 2021 touching nearly 800 million ounces, as mine output continues to decline.

Yet, the demand continues to surge with strong industrial demand from solar panels, EVs, and advanced electronics, which rely heavily on silver.

Tight Physical Supply And Backwardation

In addition to its best year in decades, silver has also witnessed its best monthly performance since the late-70s, gaining 33.16% since the beginning of December.

This was driven by tightening physical supplies across key global markets, with inventories on the Shanghai exchanges described as being “at decade lows.”

As a result, the silver market experienced something known as “backwardation,” where the spot price of an asset is higher than its futures price, a phenomenon which is relatively rare in precious metals markets.

In early October, this reached its steepest level with front-month futures contracts trading $2.88 higher than future-dated ones, hinting at acute physical shortages in global markets, according to a report by MetalsEdge.

The rally last week was sparked by China’s decision to restrict exports of the commodity beginning in January. The move prompted concerns from Tesla Inc. (NASDAQ:TSLA) CEO, Elon Musk, who said, “this is not good,” while noting the various industrial use cases of silver.

How Should Investors Play This?

According to Ramnivas Mundada, director of Economic Research at GlobalData, “This rally marks the beginning of a structural shift away from a U.S.-centric framework toward a more multipolar order.”

Highlighting the strong industrial demand, Mundada said prices could test $85–$100 per ounce as these structural deficits widen.

Investors seeking exposure to the commodity can consider cheap, convenient and straightforward options such as the iShares Silver Trust (NYSE:SLV), which directly holds the metal in its physical form, at its vaults in London.

But the upside doesn’t stop at the metal itself. The surge in silver prices has not yet been fully priced into leading producers and junior miners, leaving room for meaningful value creation in the short run.

Here is a list of miners, junior miners and ETFs for investors to consider,

| Stocks / ETFs | Year-To-Date Performance | Month-To-Date Performance |

| Wheaton Precious Metals Corp. (NYSE:WPM) | +102.14% | +6.73% |

| Americas Gold And Silver Corp. (NYSE:USAS) | +452.04% | +14.62% |

| Coeur Mining Inc. (NYSE:CDE) | +195.32% | +7.96% |

| Aya Gold & Silver Inc. (OTC:AYASF) | +79.72% | +1.82% |

| New Pacific Metals Corp. (NYSE:NEWP) | +180.95% | +24.21% |

| iShares MSCI Global Silver and Metals Miners ETF (BATS:SLVP) | +181.46% | +7.05% |

| Amplify Junior Silver Miners ETF (NYSE:SILJ) | +164.92% | +6.86% |

The spot price of silver is up 3.76% on Tuesday, trading at $74.85 an ounce, below its all-time high of $82.95 an ounce last week.

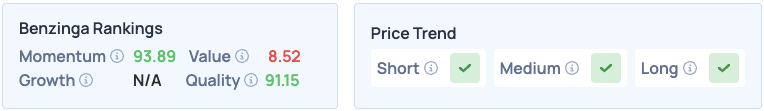

Shares of Wheaton Precious Metals score high on Momentum and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here to see how it compares with other silver miners and ETFs.

Read More:

Photo by VladKK via Shutterstock

Recent Comments