Shares of Rivian Automotive Inc (NASDAQ:RIVN) are trading lower Tuesday afternoon, paring gains after touching 52-week highs earlier in December. The stock is still up 14% over the past month and nearly 48% year-to-date, reflecting investor enthusiasm for the electric-vehicle maker’s self-driving and AI strategy.

- Rivian Automotive stock is feeling bearish pressure. What’s weighing on RIVN shares?

What To Know: The recent rally to highs was ignited by Rivian’s Autonomy & AI Day on Dec. 11, when the company unveiled its custom Rivian Autonomy Processor chip, a Gen-3 autonomy computer able to process five billion pixels per second, and a roadmap targeting Level 4 capability with LiDAR-equipped R2 models expected from late 2026.

Rivian also detailed an Autonomy+ driver-assist subscription, priced at $2,500 upfront or $49.99 per month, undercutting Tesla’s Full Self-Driving and creating a software revenue stream, with launch planned for early 2026.

Rivian shares pulled back in mid-December amid profit-taking, even as analysts at Wedbush, Baird, Goldman Sachs and Needham raised price targets into the mid-$20s following the AI Day announcements.

A Benzinga year-in-review report noted Rivian’s “mixed bag” 2025: strong third-quarter deliveries of 13,702 R1 vehicles, tariff-related cost concerns and investment in a new Georgia plant to support its R2 crossover, plus a performance-based CEO pay package worth up to $4.6 billion over 10 years.

For investors, Tuesday’s pullback comes against this backdrop of ambitious autonomy plans and capital spending to build out its software-driven business.

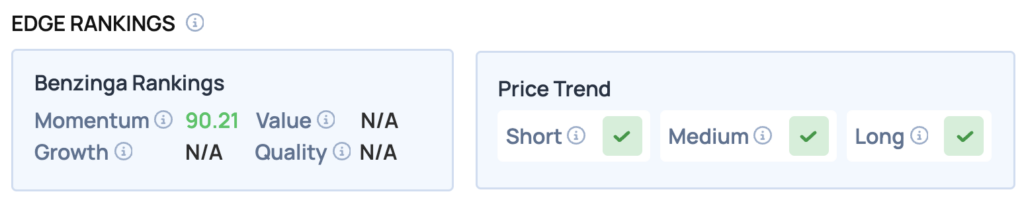

Benzinga Edge Rankings: Benzinga Edge rankings show Rivian with a strong Momentum score of 90.21, alongside bullish short-, medium- and long-term price trend indicators, underscoring the stock’s recent strength despite Tuesday’s pullback.

RIVN Price Action: Rivian Automotive shares were down 6.34% at $19.36 at the time of publication on Tuesday, according to Benzinga Pro data.

The technical outlook for Rivian suggests that while the stock has experienced a pullback, it remains in a relatively strong position compared to its recent historical performance. The distance from the support level indicates that there is room for further declines before a potential reversal could occur.

Investors should remain vigilant for signs of stabilization around the $19.28 level, which could provide a buying opportunity if the stock shows resilience.

EXCLUSIVE: SpaceX IPO Could ‘Open The Floodgates’ – How Private Companies, Tesla Will Be Impacted

Image: Shutterstock

Recent Comments