Economist Peter Schiff said in an interview aired Monday that people will lose faith and dump their Bitcoin (CRYPTO: BTC) once Michael Saylor ceases his buying spree for Strategy Inc. (NASDAQ:MSTR).

Saylor’s Buying Spree Shapes Bitcoin’s Future?

Speaking to cryptocurrency influencer Kyle Chassé, Schiff argued that Bitcoin’s rise has been fueled primarily by Strategy’s continuous accumulation.

“Basically, he’s [Saylor] the reason that Bitcoin is as high as it is,” Schiff said. “He is a huge factor, and it’s not just Strategy’s buying of Bitcoin that has fueled it, but because people know that he’s going to keep buying Bitcoin.”

Schiff believes that once Saylor stops purchasing Bitcoin, the market’s trust in the cryptocurrency could falter.

“At some point, he’s going to run out of firepower, and he’s probably very close to having to stop buying Bitcoin and then the key is going to be when does he has to start selling it because that’s going to happen,” the Bitcoin skeptic theorized.

He speculated that Strategy offloading its BTC could trigger a selling spree among other investors.

Strategy didn’t immediately return Benzinga’s request for comment.

See Also: How The CLARITY Act Could Boost Stablecoin Adoption In 2026 – Benzinga

Can Strategy Survive A Major Market Dip?

Schiff’s remarks come even as the Michael Saylor-led company reported buying 1,229 BTC for $108.8 million, bringing its total holdings to 672,497 BTC, acquired for $50.44 billion.

Strategy’s market valuation stands at $48 billion, while its Bitcoin holdings are valued at a little over $58 billion. This means that the stock is trading at a discount to its net asset value, or NAV.

Moreover, the stock has more than halved in value in the last three months, significantly underperforming Bitcoin itself.

Saylor, meanwhile, has defended the company’s business model. He stated that as long as Bitcoin increases by1.25% annually, Strategy can maintain its dividend payments indefinitely and boost shareholder value. He also claimed that the company is “engineered” to endure an 80 to 90% drawdown and continue operating.

He, however, admitted that the company is open to selling a small portion of its Bitcoin in the best interest of shareholders.

Price Action: At the time of writing, BTC was exchanging hands at $87,113.88, down 2.30% in the last 24 hours, according to data from Benzinga Pro.

Strategy shares fell 0.25% in after-hours trading to $154.99. The stock closed 2.15% lower at $155.39 during Monday’s regular trading session.

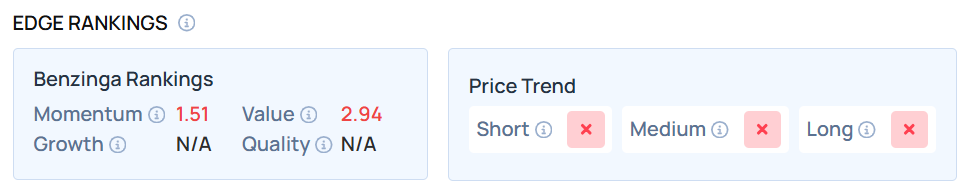

The stock maintains a weaker price trend over the short, medium and long terms. How does it compare with Bitmine Immersion Technologies Inc. (NYSE:BMNR) and other cryptocurrency treasury stocks? Visit Benzinga Edge Stock Rankings to find out.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Recent Comments