Mark Zuckerberg-led Meta Platforms Inc. (NASDAQ:META) has accelerated its artificial intelligence push with the acquisition of Manus AI, a fast-rising Chinese startup focused on autonomous agents.

Meta Expands Beyond Chatbots Into Autonomous AI Agents

Manus develops general-purpose AI agents designed to function like digital employees, capable of handling research, automation and multi-step tasks with minimal prompting.

On Monday, Meta announced plans to operate and commercialize the Manus service, integrating the technology into Meta AI and other products.

Financial terms of the deal were not disclosed.

See Also: Meta Resets AI, Hardware Plans As ‘Avocado’ Delays, Leadership Turmoil, Cost Cuts Mount

Deal Follows Meta’s $29 Billion Scale AI Investment

Alexandr Wang, chief AI officer at Meta and founder of Scale AI, in which the social media giant acquired a 49% stake, confirmed the deal on X.

The Manus acquisition builds on Meta’s aggressive AI strategy earlier this year, when the company invested in Scale AI in a deal valuing the data-labeling firm at $29 billion and brought Wang into Meta’s leadership orbit.

Manus Claims Edge Over OpenAI’s DeepResearch

Earlier this year, Manus launched its AI agent and stated performance advantages over OpenAI’s DeepResearch tool.

The startup, which is part of Beijing Butterfly Effect Technology Ltd., drew attention by completing dozens of real-world tasks for users on X at no cost.

In May 2025, Manus AI also raised $75 million in new funding in a round led by Benchmark, with participation from Tencent Holdings (OTC:TCEHY), ZhenFund and HongShan Capital.

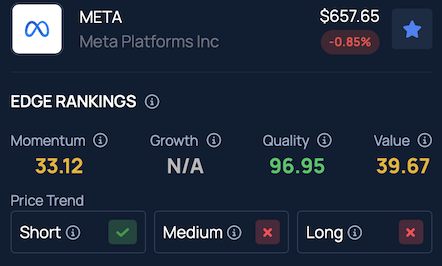

Price Action: Meta shares were down 0.69% during the regular hours on Monday and slipped another 0.27% in after-hours trading, according to Benzinga Pro.

Benzinga Edge Stock Rankings show Meta facing a bearish outlook over the medium and long term, despite maintaining a positive price trend in the short term. Click here to see how it stacks up against competitors.

Read Next:

Photo Courtesy: PJ McDonnell on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments