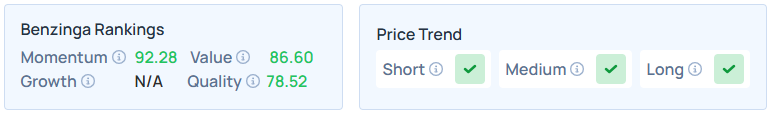

Alcoa Corp. (NYSE:AA) surged into the top 10th percentile of momentum-ranked stocks this week, with its Benzinga Edge’s Stock Rankings‘ momentum percentile jumping from 84.25 to 92.28—an 8.03-point delta signaling strong price strength and growing investor optimism amid an aluminum market recovery.

Momentum Surge Highlights Building Strength

Benzinga Edge data shows Alcoa’s momentum score catapulting into elite territory, reflecting robust relative price performance and lower volatility compared to peers over multiple timeframes.

The upward trends are confirmed across short, medium, and long periods, aligning with the company’s role as a key supplier of lightweight aluminum alloys to Ford Motor Co. (NYSE:F) for F-150 truck bodies and RTX Corp.‘s (NYSE:RTX) Pratt & Whitney jet engine components.

The stock also has robust quality and value rankings. Additional information is available here.

Analyst Upgrades Fuel Confidence

Recent analyst actions have bolstered the bullish case. Wells Fargo raised its price target to $58 from $40, while Citi lifted its to $54 from $42 in December 2025, as per Nasdaq and TradingView.

Other firms, including UBS and BMO, have reiterated positive views, contributing to a consensus “Buy” rating and average target of around $49-50.

Aluminum Market Recovery Underpins Gains

Aluminum prices have climbed nearly 17% in 2025, recently nearing $2,970 per tonne—the highest since May 2022—driven by tightening global supply, including smelter shutdowns and China’s output caps.

Analysts note Alcoa’s vertical integration positions it for significant EBITDA upside in this cyclical recovery.

Alcoa: Stock Performance In 2025

Shares of Alcoa have surged 41.54% year-to-date, 82.21% over the last six months, and 29.10% in the last month.

However, the stock closed 0.88% lower at $53.77 apiece on Monday and was up 1.04% in premarket on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments