During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

Vitesse Energy Inc (NYSE:VTS)

- Dividend Yield: 11.79%

- Evercore ISI Group analyst Chris Baker maintained an In-Line rating and lowered the price target from $22 to $20 on Oct. 6, 2025. This analyst has an accuracy rate of 69%.

- Roth MKM analyst John White maintained the stock with a Buy rating and increased the price target from $30.5 to $33 on April 2, 2025. This analyst has an accuracy rate of 62%

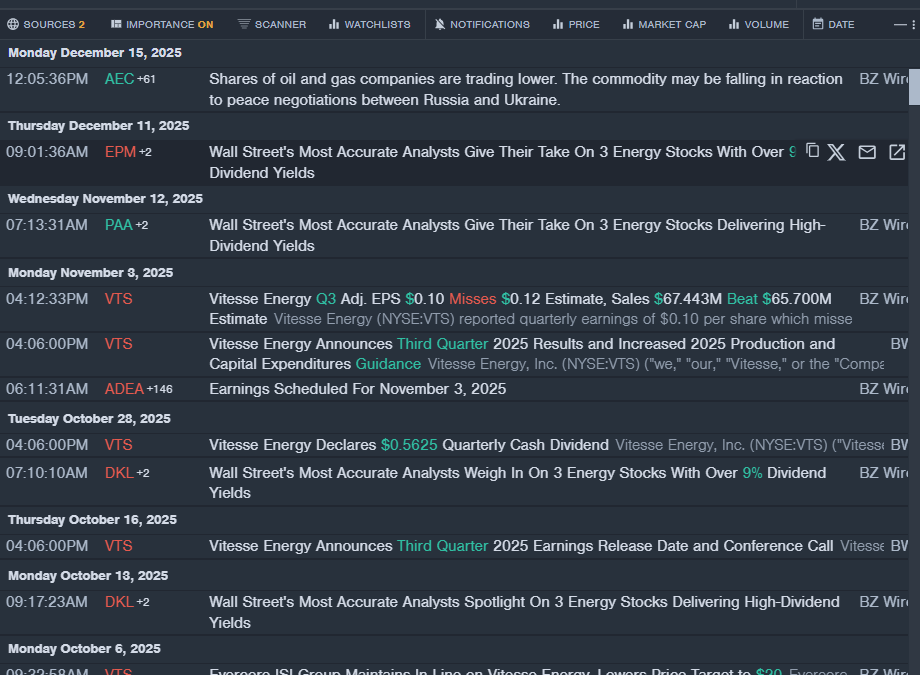

- Recent News: On Nov. 3, Vitesse Energy posted mixed quarterly results.

- Benzinga Pro’s real-time newsfeed alerted to latest VTS news.

Nordic American Tankers Ltd (NYSE:NAT)

- Dividend Yield: 10.50%

- Jefferies analyst Omar Nokta maintained a Hold rating with a price target of $3.5 on Nov. 28, 2025. This analyst has an accuracy rate of 70%.

- Evercore ISI Group analyst Jonathan Chappell maintained an In-Line rating and raised the price target from $2.5 to $3 on Oct. 28, 2025. This analyst has an accuracy rate of 65%

- Recent News: On Dec. 18, NAT entered into firm agreements to sell two Suezmax tankers at a net price of $50 million for both vessels.

- Benzinga Pro’s real-time newsfeed alerted to latest NAT news

Evolution Petroleum Corp (NYSE:EPM)

- Dividend Yield: 13.41%

- Roth Capital analyst Nick Pope reinstated the stock with a Buy rating and announced a $5 price target on Dec. 4, 2025. This analyst has an accuracy rate of 60%.

- Northland Capital Markets analyst Bobby Brooks maintained a Market Perform rating and cut the price target from $5 to $4.5 on May 20, 2025. This analyst has an accuracy rate of 75%.

- Recent News: On Nov. 11, Evolution Petroleum posted downbeat quarterly sales.

- Benzinga Pro’s real-time newsfeed alerted to latest EPM news

Read More:

Photo via Shutterstock

Recent Comments