Target Corp (NYSE:TGT) shares are trading marginally lower Monday morning, pausing after Friday’s surge. The stock’s recent volatility highlights investor optimism surrounding potential strategic shifts following reports of activist involvement. Here’s what investors need to know.

- Target stock is trading at depressed levels. Where are TGT shares going?

What To Know: Friday’s rally was sparked by a Financial Times report revealing that Toms Capital Investment Management has acquired a significant stake in the retailer.

Investors reacted positively to the news, viewing the activist stake as a potential catalyst for operational changes to unlock long-term value. In response to the report, Target reaffirmed its commitment to “getting back to growth” and improving its merchandise and shopping experience.

The activist interest comes at a critical time as Target struggles with softening demand. In its recent third-quarter earnings report, the retailer posted adjusted EPS of $1.78, beating estimates, but delivered disappointing sales of $25.27 billion, a 1.5% year-over-year decline.

Comparable sales fell 2.7%, driven by a 3.8% drop in store traffic. Furthermore, management cut its full-year 2025 adjusted EPS outlook to a range of $7.00 to $8.00, down from prior guidance.

While Target has attempted to modernize through a deepened partnership with OpenAI to enhance store operations and supply chain forecasting, the weak quarterly performance underscores the challenges Toms Capital may seek to address.

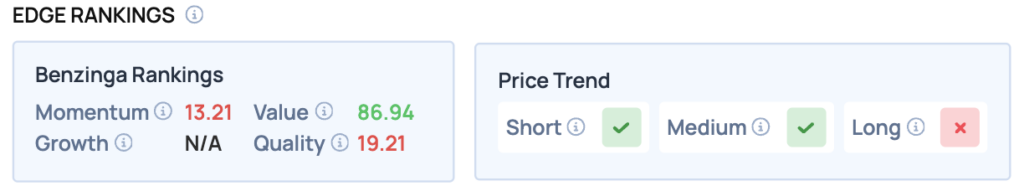

Benzinga Edge Rankings: Highlighting the stock’s current contrarian profile, Benzinga Edge data assigns Target a high Value score of 86.94, suggesting it is fundamentally undervalued, despite a lagging Momentum score of 13.21.

TGT Price Action: Target shares were down 0.88% at $98.71 at the time of publication on Monday, according to Benzinga Pro data.

The current price sits above significant historical levels, with the 52-week range stretching from $83.44 to $145.08. This broad range highlights the volatility Target has experienced over the past year, with the current price reflecting a notable recovery from the lower end of that spectrum.

Image: Shutterstock

Recent Comments