U.S. stock futures swung between gains and losses on Monday after Friday’s slightly lower close. Futures of major benchmark indices were mixed.

This will be a light week with respect to the releases of economic data, and the markets will be closed for trading on New Year’s Day, falling on Thursday.

Meanwhile, the 10-year Treasury bond yielded 4.11%, and the two-year bond was at 3.47%. The CME Group’s FedWatch tool‘s projections show markets pricing an 82.8% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Futures | Change (+/-) |

| Dow Jones | 0.03% |

| S&P 500 | -0.22% |

| Nasdaq 100 | -0.42% |

| Russell 2000 | 0.04% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Monday. The SPY was down 0.25% at $688.61, while the QQQ declined 0.46% to $621.05, according to Benzinga Pro data.

Stocks In Focus

Target

- Target Corp. (NYSE:TGT) shares were up 0.11% in premarket on Monday, following a Financial Times report indicating an activist investor, Toms Capital Investment Management, has made a significant investment in Target, though specific details of the stake were not disclosed.

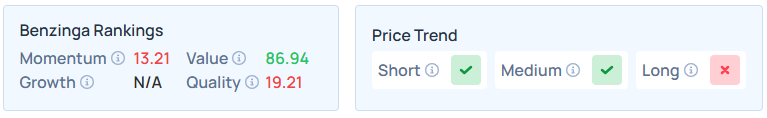

- It maintains a stronger price trend over the short and medium terms but a weak trend in the long term, with a poor quality ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Sable Offshore

- Sable Offshore Corp. (NYSE:SOC) shares fell 2.34% following an emergency lawsuit filed by environmental groups seeking to block the Donald Trump administration’s approval for restarting the Las Flores pipeline, citing fears that unaddressed safety issues could lead to another disaster.

- SOC maintains a stronger price trend over the short term but a weaker trend in the medium and long terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Bolt Projects Holdings

- Bolt Projects Holdings Inc. (NASDAQ:BSLK) surged 25.19% after it announced expected preliminary results for the fourth quarter and full year of 2025. It expects 2025 revenue to increase by 200% annually to $4.5 million.

- Benzinga’s Edge Stock Rankings indicate that BSLK maintains a weaker price trend over the short, medium, and long terms. Additional performance details are available here.

Taiwan Semiconductor Manufacturing

- Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) was 0.54% lower following a powerful earthquake near Taiwan, which has raised fresh concerns among investors about potential production disruptions.

- TSM maintains a stronger price trend over the short, medium, and long terms, with a moderate value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Coupang

- Coupang Inc. (NYSE:CPNG) rose 2.68% after the company announced a massive data breach settlement that involves distributing over $1 billion in vouchers to 33.7 million affected customers starting in January 2026.

- Benzinga’s Edge Stock Rankings shows that CPNG maintains a weaker price trend over the short, medium, and long term, with a solid growth ranking. Additional information is available here.

Cues From Last Session

While materials and information technology stocks bucked the trend to finish higher, most S&P 500 sectors—led by consumer discretionary, energy, and financials—recorded losses on Friday.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.09% | 23,593.10 |

| S&P 500 | -0.030% | 6,929.94 |

| Dow Jones | -0.041% | 48,710.97 |

| Russell 2000 | -0.54% | 2,534.35 |

Insights From Analysts

In his final analysis of 2025, Mohamed El-Erian characterizes the U.S. economy as robust but complicated by persistent inflation and rising geopolitical influence.

While highlighting that third-quarter GDP growth exceeded expectations due to “household consumption and AI-related capital spending,” he warns that high prices remain a “persistent reminder of price pressures” for many households.

Looking forward, El-Erian expects market dynamics to shift away from traditional fundamentals toward “geo-economics,” a theme where “geopolitics, national security and domestic politics” outweigh standard commercial logic.

He anticipates this will be particularly relevant as the U.S. enters the 2026 mid-term election year, forcing a political response to voter dissatisfaction with the economy.

Although the immediate “week ahead” is expected to be quiet regarding data, El-Erian cautions investors to remain vigilant about the “outsized influence of geopolitics,” specifically citing tensions in Venezuela and the Russia-Ukraine conflict as key focal points that could disrupt the broader market narrative.

See Also: How to Trade Futures

Upcoming Economic Data

Here’s what investors will be keeping an eye on this week.

- On Monday, November’s pending home sales data will be out by 10:00 a.m. ET.

- On Tuesday, October’s S&P Case-Shiller home price index for 20 cities will be released at 9:00 a.m., December’s Chicago Business Barometer (PMI) will be out by 9:45 a.m., and minutes of the Fed’s December FOMC meeting will be released by 2:00 p.m. ET.

- On Wednesday, the initial jobless claims data for the week ending Dec. 27 will be out by 8:30 a.m. ET.

- No data is scheduled to be released on Thursday and Friday.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 2.01% to hover around $57.88 per barrel.

Gold Spot US Dollar fell 1.42% to hover around $4,468.34 per ounce. Its last record high stood at $4,550.11 per ounce. The U.S. Dollar Index spot was 0.01% lower at the 98.0120 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.04% higher at $87,895.22 per coin.

Asian markets closed lower on Monday, except South Korea’s Kospi index. Australia’s ASX 200, India’s Nifty 50, China’s CSI 300, Hong Kong’s Hang Seng, and Japan’s Nikkei 225 indices fell. European markets were also lower in early trade.

Read Next:

Photo courtesy: Shutterstock

Recent Comments