Michael Saylor, co-founder of Strategy Inc. (NASDAQ:MSTR), stands as one of Wall Street’s most prominent Bitcoin (CRYPTO: BTC) backers today, yet some 12 years ago, you may have easily confused him for a “Bitcoin doomer.”

Saylor Compared Bitcoin To Gambling

On Dec. 19, 2013, Saylor posted something you’d expect from any hardcore Bitcoin skeptic

“Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling,” he wrote on Twitter, now X.

Comparisons to gambling have often been made by known Bitcoin pessimists, including veteran Wall Street investor Warren Buffett. In April 2023, the “Oracle of Omaha” labeled Bitcoin as a “gambling token” with no intrinsic worth.

Renowned economist Nouriel Roubini, also known as “Dr. Doom,” equated investing in Bitcoin and other cryptocurrencies to gambling at an “unregulated casino” in a 2019 op-ed.

Clearly, there wasn’t much separating Saylor from these skeptics if one goes by that post.

See Also: Bitcoin (BTC) Price Predictions: 2025, 2026, 2030

Saylor’s Stunning Change Of Heart

However, things have changed dramatically since then. Less than seven years from the post, Saylor’s company adopted Bitcoin as its primary reserve asset, becoming the first publicly listed company to pursue this strategy.

Today, it is the world’s largest corporate owner of Bitcoin, with a stash worth more than $59 billion, according to bitcointreasuries.net.

Moreover, hardly a day goes by that Saylor doesn’t promote the asset in his public addresses or on social media.

In fact, the level of commitment is such that he once joked, “Sell a kidney if you must but keep the Bitcoin.”

A ‘Big Mistake’

It was hardly surprising that when recently reminded of his 2013 doomsday prediction, he acknowledged it as a “₿ig Mistake.”

Price Action: At the time of writing, BTC was exchanging hands at $88,912.01, up 1.46% in the last 24 hours, according to data from Benzinga Pro.

Strategy shares closed 0.53% higher at $158.71 on Wednesday. Year-to-date, the stock has plunged 45.20%.

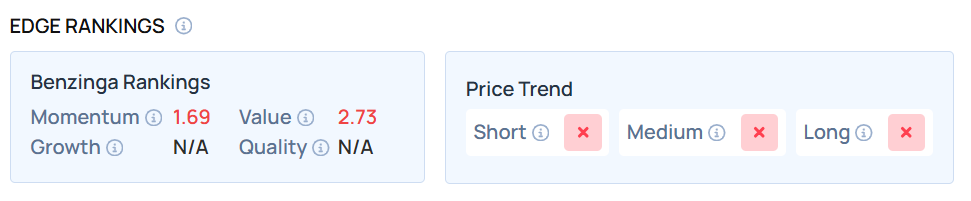

MSTR exhibited a very low Momentum score — a measure of a stock’s relative strength based on its price movement patterns and volatility over multiple timeframes. How does it compare with Coinbase Global Inc. (NASDAQ:COIN) and other cryptocurrency-linked stocks? Visit Benzinga Edge Stock Rankings to find out.

Photo by Frame Stock Footage via Shutterstock

Read Next:

Recent Comments