Chinese EV makers XPeng Inc – ADR (NYSE:XPEV), Li Auto Inc (NASDAQ:LI) and Nio Inc – ADR (NYSE:NIO) are trading higher Friday afternoon as investors bet that fresh policy and expansion headlines will translate into faster global growth. Here’s what investors need to know.

- XPeng stock is charging ahead with explosive momentum. Why is XPEV stock up today?

What To Know: A new rule from Beijing is directly lifting Chinese EV stocks, because it clearly picks efficiency winners and losers. The regulation, formally titled Energy Consumption Limits for Electric Vehicles Part 1 – Passenger Cars, is the world’s first mandatory energy-use standard for EVs.

It sets a hard ceiling on how much electricity a car can use per distance, calibrated by vehicle weight: for a typical two-tonne SUV, power consumption must not exceed 15.1 kWh per 100 kilometers (62 miles). That’s about an 11% tighter limit than today’s baseline, and any model that fails to meet it after Jan. 1, 2026 effectively cannot be sold.

Investors likely expect this to squeeze out under-scale, less efficient brands while rewarding leading Chinese EV makers that already engineer low-consumption platforms, supporting their margins and market share.

Why This Matters: The new rule appears to favor XPeng and Nio over some domestic rivals. XPeng’s core pure EVs, including the G6 crossover and P7 sedan, already sit well below the new 15.1 kWh per 100 km benchmark for roughly two-ton vehicles, while Nio’s ET5 sedan also meets the tighter 2026 threshold with room to spare.

By contrast, Li Auto’s high-volume L-series range-extender SUVs fall under a different regulatory framework, and its heavy Li Mega MPV only just clears a looser cap for large vehicles, meaning XPeng and Nio are potentially structurally better positioned under Beijing’s efficiency push.

What Else: XPeng shares jumped nearly 8% after the company held a brand-launch event in Doha, Qatar, displaying its G9 and G6 SUVs and previewing the P7+ sedan for a future local rollout. The event showed that XPeng’s exclusive distribution deal with Pioneer Motors is moving from paper to physical showrooms and orders.

The company also highlighted plans to start EV production in Malacca, Malaysia in 2026, which would add a third localized factory and lower shipping and manufacturing costs for ASEAN and European exports. Together, the announcements pointed to a clearer volume ramp and margin improvement, sparking heavy buying in XPEV Friday.

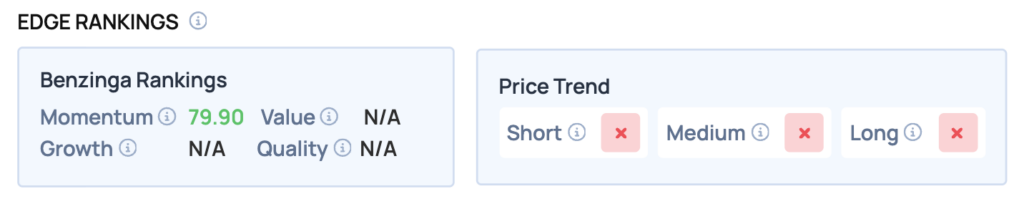

Benzinga Edge Rankings: Benzinga Edge data highlights a Momentum score of 79.90, indicating significant trading activity and interest despite negative signals across short, medium and long-term price trends.

Price Action:

- XPeng shares were up 6.73% at $20.88 at the time of publication on Friday, according to Benzinga Pro data.

- Li Auto shares were up 3.13% at $17.30.

- Nio shares were up 4.38% at $5.12.

Read Also: S&P 500 Chases 8th Straight Green Month — History Offers A Clear Message

Image: Shutterstock

Recent Comments