Silver futures surged to a historic $75 per ounce on December 26, capping off a breathtaking rally that has pushed the metal into uncharted territory. The move has been driven in large part by acute physical shortages in China, where a retail buying frenzy has collided with tight supply, sending prices sharply higher.

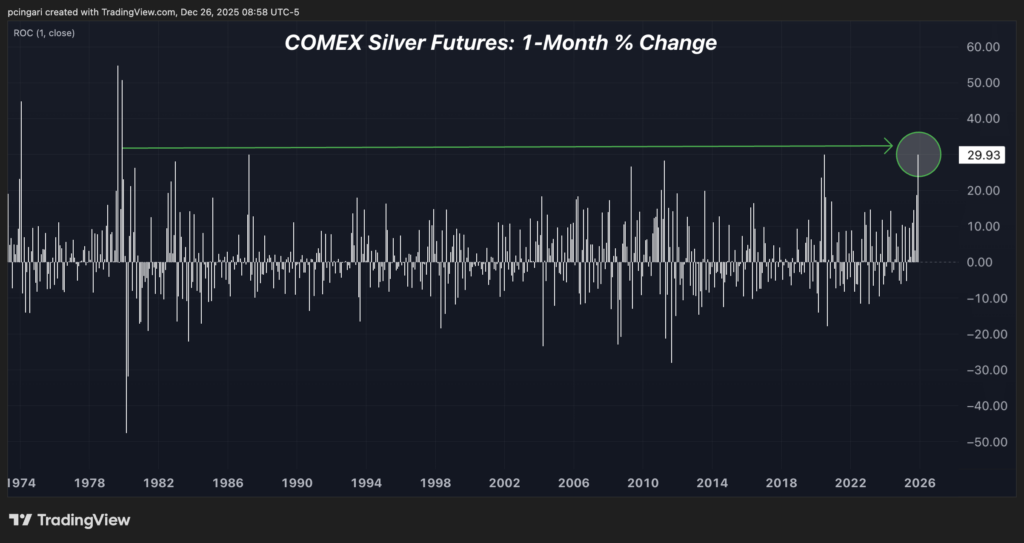

Month to date, COMEX silver – as tracked by the iShares Silver Trust (NYSE:SLV) – is up roughly 30%, putting it on pace for its best monthly performance since December 1979.

On a year-to-date basis, the metal has gained nearly 155%, also marking its strongest annual performance since the late 1970s — a period remembered for the infamous Hunt brothers’ attempt to corner the silver market.

“China is facing a literal shortage of physical silver,” wrote ‘The Kobeissi Letter’ on social media X, underscoring how quickly conditions have tightened in the world’s largest silver-consuming nation.

China’s Silver Frenzy Reaches Extreme Levels

As reported by Bloomberg on Friday, the silver rally has sparked extraordinary behavior in China’s investment markets.

The country’s only pure-play silver fund, the UBS SDIC Silver Futures Fund LOF, announced it will close subscriptions to certain shares after repeated risk warnings failed to cool speculative demand.

The fund’s manager cited concerns that investors could face heavy losses if the record-breaking bull market reverses. At one point this week, the fund was trading at a premium exceeding 60% to the value of its underlying assets — silver contracts on the Shanghai Futures Exchange.

Social media played a central role. Bloomberg noted that posts on Xiaohongshu (also known as Rednote) circulated arbitrage tutorials, drawing waves of retail traders into the fund.

The product hit its 10% daily limit for three consecutive days, prompting UBS SDIC to sharply restrict subscriptions. Even after pullbacks, the fund’s premium remains far above early-December levels.

The UBS SDIC silver fund is now up 187% this year, compared with roughly 145% gains in Shanghai-traded silver futures, highlighting just how extreme the retail-driven surge became.

Is It Too Late To Buy Silver? Rich Dad Poor Dad’s Kiyosaki Eyes $200

With silver trading above $70 and briefly touching $75, the inevitable question is whether the move is already exhausted. Robert Kiyosaki, author of Rich Dad Poor Dad, indicates it may only be the beginning.

In a post on X, Kiyosaki said he believes $200 silver is a plausible scenario by 2026, framing the current rally as part of a much larger structural shift rather than a speculative peak.

“If you think silver is at an all time high then you’re too late,” he said.

He added, “I continue to acquire silver at $70 an ounce.”

According to Ramnivas Mundada, director of Economic Research at GlobalData, the 2025 surge in precious metals reflects a deeper transformation in the global monetary system.

“This rally marks the beginning of a structural shift away from a U.S.-centric framework toward a more multipolar order,” Mundada wrote, pointing to geopolitical instability, a slowing U.S. economy, trade frictions, and accelerating de-dollarization.

On fundamentals, Mundada highlights strong industrial demand, particularly from solar panels and electric vehicles, suggesting silver prices could test $85–$100 per ounce as structural deficits widen.

The upside, he notes, is wealth preservation and diversification against systemic risk; the downside is the potential for sharp, sentiment-driven corrections and rising input costs across technology supply chains.

Looking Ahead

Whether silver pauses, corrects, or continues its historic ascent into the new year, one thing is clear: the metal has reasserted itself at the center of global markets, driven by a potent mix of industrial demand, monetary uncertainty, and retail speculation — especially in China — as the world edges into a more fragmented, multipolar financial era.

Read now:

Image: Shutterstock

Recent Comments