Sidus Space Inc (NASDAQ:SIDU) shares are trading higher Friday morning, extending a 260% move higher during a week defined by extreme volatility, conflicting catalysts and a completed capital raise. Here’s what investors need to know.

- Sidus Space stock is among today’s top performers. What’s fueling SIDU momentum?

What To Know: The space and defense technology company has seen its stock swing wildly this week, driven by a major government contract followed immediately by share dilution.

The week’s action began with a massive surge on Monday, sending shares up over 90% after Sidus was selected as an awardee for the Missile Defense Agency’s SHIELD IDIQ program to support the “Golden Dome” initiative.

However, the rally was briefly derailed Tuesday by a sharp sell-off when the company priced a public offering of over 19 million Class A shares at $1.30 per share.

Investors appear to have digested the dilution, shifting focus back to the company’s long-term growth potential. Sidus announced the closing of the offering on Wednesday, securing approximately $25 million in gross proceeds.

Management intends to deploy this capital toward manufacturing expansion, product development and operational costs to scale its commercial and defense solutions.

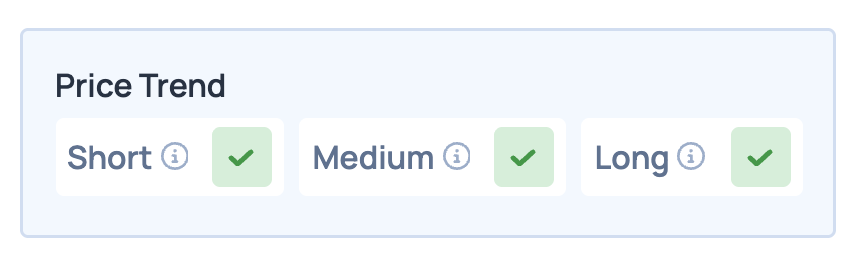

Benzinga Edge Rankings: Benzinga Edge rankings highlighted in the report indicate underlying technical strength, with positive Price Trend indicators across short, medium and long-term horizons.

SIDU Price Action: Sidus Space shares were up 25.00% at $2.722 at the time of publication on Friday, according to Benzinga Pro data.

Support levels can be identified at around $2.50, where the stock may find buying interest if it experiences any pullbacks. This level could serve as a critical point for traders looking to enter positions or for existing shareholders to assess their strategies.

Read Also: China’s New EV Energy Limits Contrast With US Rollback Of Fuel Economy Standards

Image: Shutterstock

Recent Comments