Rigetti Computing Inc (NASDAQ:RGTI) is trading lower Friday afternoon, marking a reversal after a surge earlier in the week driven by retail momentum and sector-wide optimism. The recent volatility comes amid a classic Santa Rally, where retail investors earlier this week rotated into high-beta quantum stocks while institutional trading desks thin out for the holidays.

- Rigetti Computing stock is showing notable weakness. What’s pressuring RGTI stock?

What To Know: Earlier gains this week were fueled by a wave of social media sentiment focused on Rigetti’s 2026 roadmap, which promises higher-qubit systems and significantly lower error rates. This retail interest was compounded by a halo effect from peers like IonQ and D-Wave, which also saw spikes following strategic milestones and bullish analyst coverage.

Notably, Wedbush recently initiated coverage on Rigetti with an Outperform rating and a $35 price target, citing the company’s advanced chiplets and vertically integrated production capabilities as key differentiators.

Market observers note that this week’s price action fits the pattern of a “Holiday Gap,” where lower trading volumes between Dec. 20 and New Year’s allow retail sentiment to move small-cap stocks more aggressively.

While retail investors likely drove the stock higher earlier in the week on the belief that the “quantum age” could arrive by 2026, Friday’s downturn suggests a pause in the momentum as the holiday period progresses.

What Else: Investors in recent months have also tracking a growing correlation between quantum and space stocks, which have moved in tandem during recent rallies and pullbacks. Quantum computing has been increasingly viewed as a strategic peer to the space and AI sectors, driven by shared national defense priorities.

The Trump administration has also made quantum technologies a focal point of U.S. innovation in recent months, embedding them alongside AI in the FY2027 federal R&D roadmap.

Meanwhile, Benchmark analyst David Williams in October called Rigetti’s modular design a competitive advantage for the integration of quantum chiplets into the scalable systems required for these advanced strategic applications.

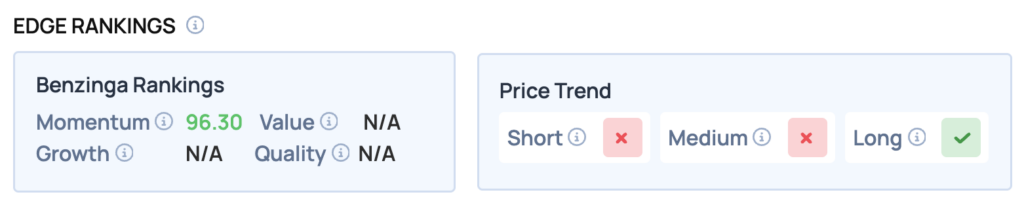

Benzinga Edge Rankings: Despite the afternoon sell-off, Benzinga Edge data indicates significant underlying interest, highlighting a bullish Momentum score of 96.30 for the stock.

RGTI Price Action: Rigetti Computing shares were down 6.61% at $72.10 at the time of publication on Friday, according to Benzinga Pro data.

In terms of support and resistance levels, the stock appears to have established a critical support zone around the $22.90 mark, which was tested during the trading session.

Should the price break below this level, it could open the door for further declines, potentially retesting the lower end of its 52-week range.

Read Also: Nvidia Stock Climbs As The King Of AI Defends Its Throne

Image: Shutterstock

Recent Comments