Groq announced a non-exclusive licensing agreement with Nvidia Corp. (NASDAQ:NVDA) for its inference technology on Wednesday, aiming to boost high-performance AI inference worldwide. The reportedly 20.6 billion cash deal highlights collaboration between the AI chip innovators amid surging demand for efficient inference solutions.

Groq To Remain An Independent Company

Groq has entered into a non-exclusive licensing agreement with Nvidia covering its inference technology. Groq reports the pact focuses on expanding access to high-performance, low-cost inference capabilities. As part of the arrangement, Jonathan Ross, Groq’s Founder, Sunny Madra, Groq’s President, and other team members will join Nvidia to advance the licensed technology.

Ross confirmed on X that he would be joining Nvidia and would help to integrate the “licensed technology.” The Groq CEO said, “GroqCloud will continue to operate without interruption.”

Groq will remain an independent company, with Simon Edwards stepping up as Chief Executive Officer. GroqCloud services will continue operating seamlessly without disruption.

Nvidia agreed to buy assets from AI chip startup Groq for $20 billion in cash, according to Disruptive CEO Alex Davis, who is associated with Groq’s last financing round in September, as reported by CNBC. Davis said the deal came together quickly, noting his firm has invested more than $500 million in Groq since its founding in 2016.

Deal Comes After Funding Rounds

This agreement bridges two leaders in AI hardware, combining Groq’s specialized inference speed with Nvidia’s vast ecosystem. It comes after Groq’s recent funding rounds, including a $750 million raise earlier this year that valued the firm highly amid AI boom.

Prior reports noted Groq’s ambitions to rival Nvidia in inference chips, with backing from investors like Cisco and Samsung. The executive transition underscores the technology’s potential, positioning Nvidia to integrate Groq innovations for broader AI scaling.

“The agreement reflects a shared focus on expanding access to high-performance, low cost inference,” the announcement stated.

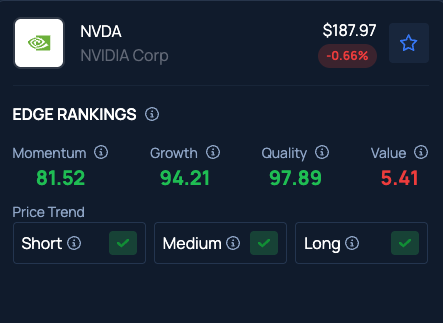

Benzinga Edge Stock Rankings indicate Nvidia stock has a Value in the 5th percentile. Here is how the stock ranks on other metrics.

Photo Courtesy: T. Schneider on Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Recent Comments