Wall Street experienced a modest rally as the S&P 500 reached new heights, closing up 0.2% in a shortened session before the Christmas break. The index’s year-to-date gains now stand at 17%.

The Dow Jones Industrial Average climbed 0.6% to 48,731.16, while the S&P 500 added 0.32% to close at 6,932.05. The Nasdaq also edged higher, rising 0.22% to 23,613.30.

These are the top stocks that gained the attention of retail traders and investors through the day:

Nike Inc. (NYSE:NKE)

Nike’s stock surged 4.64% to close at $60, reaching an intraday high of $60.58 and a low of $58.88. The stock’s 52-week range is between $82.44 and $52.28.

Apple Inc. CEO Tim Cook recently purchased 50,000 shares of Nike at an average price of $58.97, totaling nearly $3 million. Cook’s investment has increased his stake in the company.

Nike shares rose after filings showed Cook made his first open-market purchase of Nike stock, buying the 50,000 shares and lifting his stake to roughly $6.0 million, following a separate insider buy by director Robert Swan. The move came after Nike beat second-quarter estimates with $12.43 billion in revenue and 53 cents in EPS, but warned that third-quarter revenue could fall in the low single digits, citing a $1.5 billion annualized tariff headwind and continued weakness in China.

Omeros Corporation (NASDAQ:OMER)

Omeros saw a remarkable increase of 75.54%, closing at $15.36, with an intraday high of $17.65 and a low of $13.92. The stock’s 52-week high and low are $17.65 and $2.95, respectively.

The FDA approved Omeros’ Yartemlea for treating transplant-associated thrombotic microangiopathy in adults and children aged two and older, marking the first approved lectin pathway inhibitor for this condition. Approval was based on studies showing complete response rates of about 61%–68% and roughly 73%–74% 100-day survival, with data suggesting significantly lower mortality versus historical controls; Omeros planned a U.S. launch for January 2026.

See Also: The Real Reason Bitcoin Dropped Like A Stone From Its $126,000 All-Time High

Micron Technology Inc. (NASDAQ:MU)

Micron’s shares rose 3.77% to close at $286.68, hitting an intraday high of $289.30 and a low of $277.25. Its 52-week range is $289.30 to $61.54.

Micron Technology shares surged to a fresh all-time high after the company reported blockbuster first-quarter results last week, with revenue of $13.64 billion and adjusted earnings of $4.78 per share, both well above expectations. The rally was driven by Micron’s central role in artificial intelligence infrastructure, particularly its high-bandwidth memory business, which management said could grow from about $35 billion in 2025 to $100 billion by 2028. CEO Sanjay Mehrotra guided for record revenue and margins in fiscal 2026, including $18.7 billion in second-quarter revenue, reinforcing bullish sentiment.

Intel Corporation (NASDAQ:INTC)

Intel’s stock dipped 0.52% to close at $36.16, with an intraday high of $36.17 and a low of $34.95. The 52-week range is between $44.01 and $17.67.

Intel shares edged lower after a report said Nvidia had paused testing Intel’s 18A manufacturing process for its advanced AI chips, dealing a setback to Intel’s efforts to attract major foundry customers. The move was seen as a blow to Intel’s ambitions to challenge Taiwan Semiconductor, even as the company insisted its next-generation manufacturing roadmap remains on track. The report came despite Nvidia’s previously announced $5 billion investment and broader partnership with Intel, which executives had framed as collaborative rather than manufacturing-focused.

Dynavax Technologies Corporation (NASDAQ:DVAX)

Dynavax shares jumped 38.19% to close at $15.38, with an intraday high of $15.49 and a low of $15.38. The stock’s 52-week range is $15.49 to $9.20.

The surge is attributed to Sanofi’s acquisition of Dynavax, which adds a marketed adult hepatitis B vaccine to its portfolio. Sanofi said it agreed to acquire Dynavax Technologies in an all-cash deal valued at about $2.2 billion, strengthening its presence in adult vaccines, according to a press release. The French drugmaker planned to pay $15.50 per share, representing a roughly 39% premium to Dynavax’s prior close, and aimed to close the transaction in the first quarter of 2026. The deal added Dynavax’s marketed hepatitis B vaccine HEPLISAV-B and an early-stage shingles candidate to Sanofi’s vaccine portfolio. Sanofi said it would fund the acquisition with available cash, subject to regulatory approvals and shareholder tender conditions.

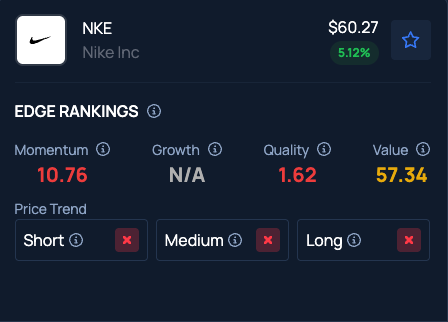

Benzinga Edge Stock Rankings indicate Nike stock has a Momentum in the 10th percentile. Here is how the stock ranks against Sneaker rivals like ON Holding.

Photo Courtesy: Miha Creative on Shutterstock.com

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Recent Comments