Christmas brings cheer, cakes and cozy vibes, but it can also be a perfect time for kicking off investments you may not have considered before. A handful of Bitcoin (CRYPTO: BTC) mining stocks have delivered strong gains this year, making them worth a look.

| Company | YTD Gains +/- |

| IREN Ltd. (NASDAQ:IREN) | +328.41% |

| Cipher Mining Inc. (NASDAQ:CIFR) | +242.89% |

| Riot Platforms Inc. (NASDAQ:RIOT) | +33.89% |

| CleanSpark Inc. (NASDAQ:CLSK) | +24.97% |

IREN

IREN’s transition from mining to high-performance data centers for artificial intelligence and graphics processing unit cloud services has boosted the company’s share price this year.

The company secured major deals this year, including the $9.7 billion GPU cloud contract with Microsoft Corp. (NASDAQ:MSFT). The agreement includes a 20% prepayment from Microsoft and commits IREN to purchasing $5.8 billion in NVIDIA Corp. (NASDAQ:NVDA) GPUs and related equipment from Dell Technologies Inc. (NYSE:DELL).

The stock has a consensus price target of $55.73 based on the ratings of 17 analysts, with a high of $136 by Cantor Fitzgerald last month.

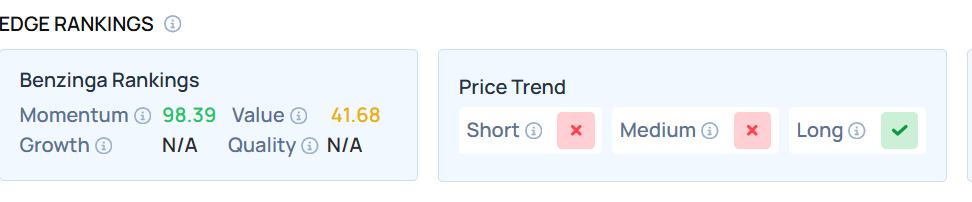

Benzinga’s proprietary Edge Rankings show Momentum as the strongest category for IREN at 98.39/100. To know more about the stock, click here.

Cipher Mining

Cipher Mining stock rallied strongly in 2025, surging about 380% in the last six months alone due to a strategic pivot from Bitcoin mining to AI infrastructure.

Key wins included long-term contracts such as a 15-year arrangement with Amazon.com Inc.’s (NASDAQ:AMZN) Web Services for 300 MW of electricity and space, valued at roughly $5.5 billion. It also Cipher signed a $3 billion, 10-year colocation deal with Fluidstack, including support and partial backing from Google.

The stock has a consensus “Buy” rating and a price target of $21.61, according to 15 analysts. The high is $34 issued by Clear Street.

CIFR demonstrated a very high Momentum score as of this writing. Do you want to know how it compares to other Bitcoin mining companies? Visit Benzinga Edge Stock Rankings.

Riot Platforms

RIOT stock recorded healthy gains in 2025, aided by Bitcoin’s all-time highs and the company’s increased mining output.

Riot CEO Jason Lee said earlier that the company intends to repurpose its power infrastructure for data centers and high-performance computing.

As of this writing, Riot is the seventh-largest corporate holder of Bitcoin, sitting on a stash worth $1.72 billion, according to Bitcoin Treasuries.net.

The Moving Average Convergence Divergence indicator, which compares two exponential moving averages of an asset, typically the 12-period and the 26-period, flashed a “Buy” signal for the stock, according to TradingView.

On the other hand, the Bull Bear Power indicator, which measures the strength of buyers and sellers, flashed a “Neutral” reading.

The stock had a stronger price trend in the short, medium and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings. To know more about the stock, click here.

CleanSpark

CleanSpark reported $766 million in fiscal year revenue, more than doubling from the prior year, driven by a sharp increase in Bitcoin mined and operational hashrate. The company said it had $43 million in cash and $1.2 billion in Bitcoin as of Sept. 30.

CleanSpark started as a Bitcoin miner but has expanded into AI data centers to diversify its revenue streams. It owns and operates data centers.

The stock has a consensus “Buy” rating with a price target of $23.69, according to 13 analysts. With an average price target of $26.33 from B. Riley Securities, Macquarie, and Chardan Capital, Cleanspark’s most recent analyst ratings indicate a 108.83% upside.

Benzinga’s proprietary Edge Rankings show Growth as the strongest category for CLSK at 99.76/100. Find out more here.

Photo Courtesy: Mcimage from Shutterstock

Read Next:

Recent Comments