This Holiday season, popular “Buy Now, Pay Later” services have accounted for a significant slice of consumer checkouts, even as rising regulatory scrutiny and debt concerns loom over the sector.

Holiday ‘Buy Now, Pay Later’ Spend Set To Touch New Record

Spending on buy now, pay later services during the holiday shopping period, which runs from Nov. 1 through New Year’s Eve, is expected to touch $20.2 billion, an 11% increase from last year, according to data from Adobe Analytics.

This does not come as a surprise, as these services become increasingly embedded into the country’s consumption culture, with the annual BNPL spending projected to hit $116.7 billion in 2025, doubling from 2022, and more than seven times higher than in 2020.

According to a survey conducted last month by PayPal Holdings Inc. (NASDAQ:PYPL), one of the biggest BNPL service providers, half of holiday shoppers are likely to complete their purchases using such services, if given an option.

“PayPal data shows offering BNPL leads to a 91% higher average order value for enterprises and 62% higher for small businesses, meaning it isn’t just a nice-to-have, it’s a proven advantage to win,” according to PayPal’s General Manager, Michelle Gill.

As this once niche offering becomes increasingly mainstream in online retail, concerns continue to mount regarding its potential impact on consumer finances and how expanding legal and regulatory scrutiny could reshape the industry.

Financial Strain On Consumers

Over the past year, a growing number of consumers have opted for buy now, pay later financing even for everyday purchases such as groceries, which highlights the financial strain among consumers.

This is concerning, considering the high fees that these services often levy on borrowers who fail to pay on time, especially since as many as 41% of users admit to missing payments, which is up from 34% last year, according to a survey conducted by LendingTree Inc. (NASDAQ:TREE).

According to financial planning experts, the impact of these services on personal finances extends far beyond just high fees and penalties, since they make it easier for consumers to take on purchases they may not be able to afford.

“The problem is that they can create a false sense of affordability, making it much easier to say yes to purchases that may not fit within someone’s broader financial situation,” says Linda Grizely, a Certified Financial Planner.

She notes that the decision to include BNPL spending and habits in credit scores is a welcome change, which helps “bring more transparency and accountability for both lenders and borrowers.”

Growing Regulatory Scrutiny

Earlier this year, conservative commentator Charlie Kirk called out the “predatory” nature of these services during an interview with Tucker Carlson, weeks before his assassination in September.

Kirk warned that the widespread use of these services could have long-term consequences on the financial health of Gen Z. “This generation can’t own anything,” he said. “They owe so much more money than generations prior.”

His comments come as momentum builds in Washington to increase oversight of this industry. Last week, Sen. Kirsten Gillibrand (D-N.Y.) introduced the Buy Now, Pay Later Protection Act, legislation that would update the Truth in Lending Act to extend credit-card-style consumer protections to certain BNPL loans.

Earlier this month, Connecticut Attorney General William Tong announced a multistate inquiry into major BNPL providers, including Affirm Holdings Inc. (NASDAQ:AFRM), Afterpay, owned by Block Inc. (NYSE:XYZ), Klarna Group PLC (NYSE:KLAR), PayPal, Sezzle Inc. (NASDAQ:SEZL) and Zip Co. Ltd. (OTC:ZIZTF).

Tong’s office said the probe seeks information on fees, disclosures, repayment structures and consumer risks, warning that BNPL products “may expose consumers to unclear terms, hidden fees, and debt traps.”

According to Braden Perry, a former CFTC enforcement attorney and partner at Kennyhertz Perry, this action by state AGs reflects deeper structural issues.

“Buy Now, Pay Later isn’t lightly regulated, but inconsistently regulated,” Perry said. “The same product can be treated as a loan in one state, an installment contract in another, and effectively unregulated in a third.”

Perry added that the fragmented system “creates confusion for the consumers (and the entities) and invites regulatory arbitrage by design,” arguing that recent attorney general actions reflect “regulatory frustration” as much as consumer protection concerns.

None of the companies responded to Benzinga’s request for a comment on this matter. This story will be updated as soon as we receive a response.

A Mixed Year For BNPL Giants

Despite their growing momentum in the online retail landscape, 2025 has broadly been a mixed bag for the buy now, pay later industry as a whole.

| Stocks / ETFs | Year-To-Date Performance |

| PayPal Holdings Inc. | -30.54% |

| Block Inc. | -24.90% |

| Affirm Holdings Inc. | +25.69% |

| Klarna Group PLC | -31.67% |

| Sezzle Inc. | +65.27% |

| Zip Co. Ltd. | +7.32% |

| Global X FinTech ETF (NASDAQ:FINX) | -2.06% |

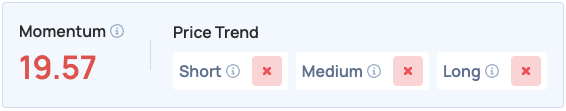

The Global X FinTech ETF, which invests across several leading “Buy Now, Pay Later” service providers, scores poorly on Momentum in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo: Drazen Zigic via Shutterstock

Read More:

Recent Comments