Trump Media and Technology Group (NASDAQ:DJT) purchased Bitcoin (CRYPTO: BTC) worth over $40 million on Monday, according to on-chain data.

Trump Media’s stock is gaining positive traction. Why are DJT shares climbing?

Trump Media’s BTC Reserve Now Worth Over A Billion

The firm, minority-owned by President Donald Trump, bought roughly 451 BTC, worth $40.30 million, from cryptocurrency exchange Crypto.com via 3 transactions, according to Arkham.

The latest grab boosted Trump Media’s Bitcoin portfolio to 11,542 BTC, valued at $1.02 billion at the prevailing prices.

The company hasn’t officially confirmed the purchase as of this writing. Benzinga has reached out for a confirmation.

See Also: Trump’s Jobs Plan Has Been An ‘Abject Failure,’ Says Economist Paul Krugman: ‘Significant Numbers’ Of Americans Regret Their Choice

Trump Family’s Bold Bitcoin Bet

The Trump family has been deepening their involvement in the Bitcoin space. Earlier this year, Trump Media submitted a filing for a “Truth Social Bitcoin ETF,” designed to track the price of the apex cryptocurrency.

Trump himself has been advocating for the asset in his addresses, calling its increasing adoption “a great thing” for the U.S.

Trump’s DJT Stake

Trump maintains a 41.5% stake in the company, according to the latest 13D filing, translating to a total of 114,750,000 shares. At Monday’s closing price, this equated to $1.65 billion.

Notably, Trump transferred his entire Trump Media stake to a trust controlled by his eldest son, Donald Trump Jr., before his swearing-in.

Price Action: At the time of writing, BTC was exchanging hands at $88,263.67, down 0.22% in the last 24 hours, according to data from Benzinga Pro.

DJT shares rose 2.16% in after-hours trading after closing 10.44% lower at $14.41 during Monday’s regular trading session. Year-to-date, the stock has plunged 57%.

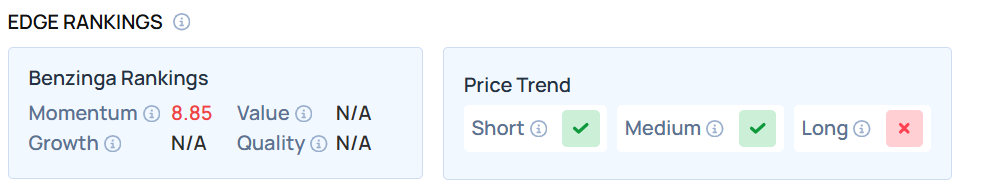

DJT performed poorly in Momentum rankings, a measure of a stock’s relative strength based on its price movement patterns and volatility over multiple timeframes, but you can always find high-momentum equities using Benzinga Edge Stock Rankings.

Photo by Frame Stock Footage via Shutterstock

Read Next:

Recent Comments