An Nvidia Corp. (NASDAQ:NVDA) partner company, which counts Microsoft Corp. (NASDAQ:MSFT), Together AI and Fluidstack among its customers, is priced very cheaply relative to its historic valuations, following the stock’s steep pullback over the past couple of weeks.

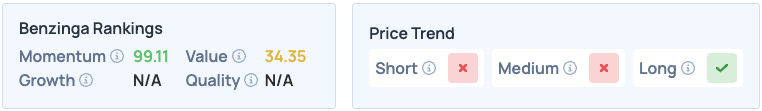

The stock in question is Australian Bitcoin (CRYPTO: BTC) miner turned neocloud, IREN Ltd. (NASDAQ:IREN), which has seen its Value metrics soar in Benzinga’s Edge Stock Rankings, amid a fall in its stock price.

Prominent Neocloud Trades Cheap

The Value metric in Benzinga’s Edge Stock Rankings ranks each company as a percentile relative to its peers, based on its core fundamentals, such as market price, earnings, assets, and more.

See Also: AI Bubble Fears Grow, But Investors Say Valuations Are Powering Next Wave Of Innovation

IREN’s Value score has surged from 29.14 to 43.37 within the span of a week, as the stock dropped 13.3% over the past month, and currently trades 45.31% below its 52-week high of $76.87 in early November, even as it secured a landmark $9.7 billion deal with Microsoft last month, while teasing more large contracts in the works.

Despite the stock’s volatility, the company reaffirmed its optimism on its AI infrastructure business by projecting $3.4 billion in annual recurring revenue towards the end of 2026, up from $501 million during fiscal year 2025.

All of these factors make the company undervalued, especially considering its recent historic averages, with the stock trading at 24 times earnings. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the long run. Click here for deeper insights into the stock, its peers and competitors.

Read More:

- This Microsoft Analyst Expects 2026 To Be A ‘Big AI Driven Growth Year’ That Will Surprise Investors

Photo courtesy: Tigarto / Shutterstock.com

Recent Comments