U.S.-listed shares of Novo Nordisk A/S (NYSE:NVO) soared 7.36% during Tuesday’s pre-market session following the approval of its GLP-1 pill by the U.S. Food and Drug Administration (FDA).

Danish Pharma Gains From FDA Approval

The Danish pharmaceutical company’s shares jumped after the FDA gave the green light to its GLP-1 pill, Wegovy on Monday. This marks the first approval of its kind globally.

The company announced that the pill’s starting dose of 1.5 milligrams will be available in pharmacies and through select telehealth providers beginning early January, priced at $149 per month.

Patients paying out of pocket can also purchase it at the same rate via President Donald Trump‘s direct-to-consumer platform, TrumpRx, under an agreement reached with his administration last month.

Novo Nordisk Faces Setbacks, Gains Lead

The approval of the GLP-1 pill comes amidst a challenging year for Novo Nordisk, characterized by board conflicts, supply chain shortages, a bidding war with Pfizer (NYSE:PFE), and criticism of its U.S. strategy. The approval also puts Novo Nordisk ahead of its U.S. competitor, Eli Lilly (NYSE:LLY), in the race for effective weight-loss drugs.

Earlier this month, Novo Nordisk submitted a New Drug Application (NDA) to the FDA for a weekly combination obesity shot, CagriSema, which consists of a long-acting amylin analogue and the GLP-1 receptor agonist, semaglutide. If approved, CagriSema would be the first injectable GLP-1 receptor agonist and amylin analogue combination treatment, providing another potential avenue for the company to solidify its position in the weight-loss market.

In November, the U.S. CMS announced negotiated lower prices for 15 high-cost drugs, set to take effect in 2027, aiming to reduce prescription expenses. Novo Nordisk’s GLP-1 drug semaglutide (Wegovy, Ozempic, Rybelsus) will have a monthly cost of $274 under the new pricing.

Despite the recent success, Novo Nordisk’s stock has faced challenges throughout the year. The company’s stock has been under pressure following disappointing results from the REDEFINE 2 phase 3 trial of CagriSema. Novo Nordisk also revised its 2025 sales growth guidance downwards multiple times, further impacting investor confidence.

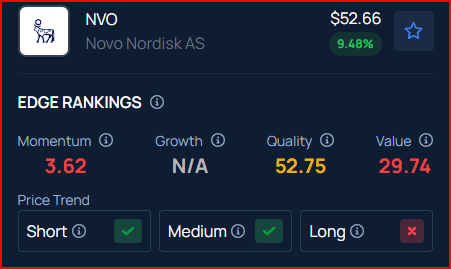

Benzinga’s Edge Rankings place Novo Nordisk in the 53rd percentile for quality and the 30th percentile for value, reflecting average performance in both areas. Check the detailed report here.

Price Action: On a year-to-date basis, Novo Nordisk stock declined 45.04%% as per data from Benzinga Pro. On Monday, it rose 0.02% to close at $88.33.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments