Citron Research, led by Andrew Left, is doubling down on its quantum computing pick, noting that it has successfully transitioned from being a conceptual science project to a commercial reality.

This Is No Longer ‘A Science Project’

On Monday, in a post on X, Left reiterated his bullish stance on Infleqtion (NASDAQ:CCCX), a neutral atom quantum technology company, citing its collaboration with French aeronautics giant, Safran SA, for GPS-independent timing solutions for “mission-critical systems.”

Left said Infleqtion, which went public via a SPAC merger earlier this year, is “no longer a science project,” signaling a shift from experimental development to what he views as a commercially viable phase. “This is real.”

See Also: What’s Going On With Quantum Computing Stocks Today?

Citron highlighted the stark contrast between Infleqtion and Rigetti Computing Inc. (NASDAQ:RGTI), another quantum computing company, which “can’t even make stage 2 with DARPA,” which refers to the benchmarks set by the U.S. Government’s Defense Advanced Research Projects Agency.

Yet, Rigetti trades at a market capitalization of $7.84 billion, while Infleqtion trades at just over $720 million. Citron said that it expects the market capitalization of the two companies to cross in early 2026.

Citron’s Long/Short Quantum Trade

Earlier this year, Citron announced that it was going long on Infleqtion while shorting Rigetti, aiming to capture the long-term divergence in their respective valuations.

In a post on X, Citron noted that the market “hasn’t priced the gap between execution and aspiration” between the two companies, while adding that Infleqtion, at that point, had customers, revenue, and a partnership with NVIDIA Corp. (NASDAQ:NVDA).

Since the firm initiated this trade, Rigetti Computing is down 35.50%, while Infleqtion is down 1.68%, amid broader skepticism surrounding quantum computing stocks.

Quantum Stocks Rally Amid Bullish Options Activity

Shares of Infleqtion were up 13.50% on Monday, closing at $15.72, along with Rigetti Computing, which was up 13.24%, trading at $26.90.

Other quantum stocks fared just as well during the year-ending Santa rally, fueled by a string of optimistic analyst coverages by Jefferies and Wedbush Securities, alongside bullish options activity, with put/call ratios below their 20-day averages for most of them.

This caps off a successful year for quantum stocks in 2025, with analysts and investors expecting the momentum to continue into the new year.

| Stocks / ETFs | 1 Day Performance | Year-To-Date Performance |

| Rigetti Computing Inc. | +13.24% | +34.53% |

| Infleqtion | +13.50% | +53.82% |

| D-Wave Quantum, Inc. (NYSE:QBTS) | +20.05% | +234.96% |

| IonQ, Inc. (NYSE:IONQ) | +11.10% | +24.97% |

| Quantum Computing Inc. (NASDAQ:QUBT) | +12.86% | -34.49% |

| Defiance Quantum ETF (NASDAQ:QTUM) | +1.36% | +36.69% |

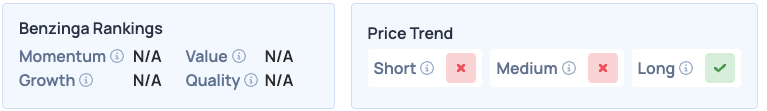

Infleqtion has a favorable price trend in the long run in Benzinga’s Edge Stock Rankings. Click here to see how it compares with Rigetti.

Photo Courtesy: JLStock from Shutterstock

Read More:

Recent Comments