AST SpaceMobile Inc (NASDAQ:ASTS) shares are bouncing around Tuesday morning after a 14% midday surge on Monday. Investors are looking ahead to the launch of the BlueBird 6 satellites, scheduled for 10:24 p.m. ET Tuesday. Here’s what investors need to know.

- AST SpaceMobile stock is showing upward bias. What should traders watch with ASTS?

What To Know: AST SpaceMobile’s next-generation satellites feature a massive 2,400-square-foot phased array antenna — the largest commercial system ever deployed in low Earth orbit — designed to beam high-speed broadband directly to standard smartphones.

Beyond the immediate catalyst, sentiment remains elevated following President Donald Trump’s “Ensuring American Space Superiority” executive order. The policy provides a specific boost for AST SpaceMobile by explicitly mandating “ubiquitous satellite-enabled communications,” effectively validating the company’s core mission as a national priority.

Additionally, the order asserts U.S. leadership in spectrum management, a critical regulatory area for the company’s expansion. This directive also accelerates a shift toward commercially driven as-a-service contract models rather than traditional government-owned systems, creating a direct tailwind for private sector integration into national infrastructure.

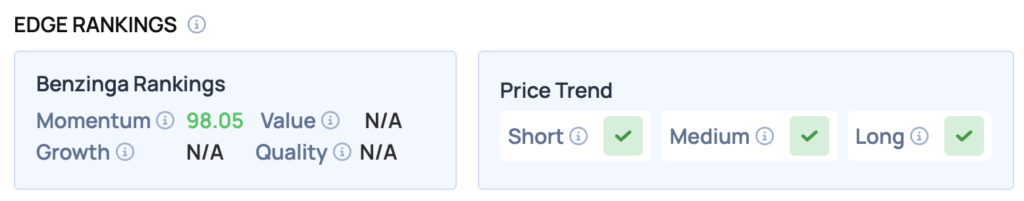

Benzinga Edge Rankings: Reflecting this technical and fundamental strength, Benzinga Edge rankings assign AST SpaceMobile a powerful Momentum score of 98.05, signaling robust strength alongside positive price trends across short, medium and long-term horizons.

ASTS Price Action: AST SpaceMobile shares opened down before briefly turning green for the session. The stock was down 2.62% at $84.30 at the time of publication on Tuesday, according to Benzinga Pro data.

Support levels can be identified around the recent low of $81.98, which may act as a floor for the stock in the short term. Should the price break below this level, it could signal a shift in momentum, prompting further selling.

On the upside, resistance is likely to be encountered near the session high of $87.75. A sustained move above this level could open the door for further gains, potentially targeting the upper end of the 52-week range.

Read Also: Economy Grows By 4.3% In Third Quarter, Strongly Beating Forecasts

Image: Shutterstock

Recent Comments