Nektar Therapeutics (NASDAQ:NKTR) stock is trading lower Monday afternoon as the market continues to assess mixed topline results from the Phase 2b REZOLVE-AA trial of rezpegaldesleukin. Here’s what investors need to know.

- Nektar Therapeutics stock is showing notable weakness. What’s behind NKTR decline?

What To Know: While the study for severe alopecia areata demonstrated a proof-of-concept, it narrowly missed its primary endpoint for the full patient cohort.

The investigational biologic failed to achieve statistical significance in the intent-to-treat analysis, showing a mean SALT score reduction of 28.2% and 30.3% in the treatment arms versus 11.2% for placebo (p=0.186 and p=0.121).

However, Nektar reported that when excluding four patients with major eligibility violations, both dosage arms achieved statistical significance (p<0.05). The company highlighted that rezpegaldesleukin more than doubled the treatment effect of placebo and plans to advance the drug into Phase 3 development in 2026.

Despite the sell-off, Wall Street analysts responded with bullish revisions following the data release. BTIG maintained a Buy rating and raised its price target to $118 from $100, while H.C. Wainwright & Co. hiked its target to $135 from $120, implying an upside of over 200%.

Analysts appear encouraged by the clean safety profile and the drug’s potential as a first-in-class Treg mechanism, viewing the adjusted data as a validation of efficacy despite the headline miss.

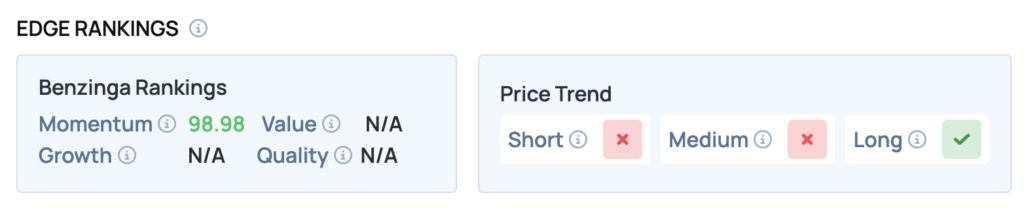

Benzinga Edge Rankings: According to Benzinga Edge rankings, NKTR currently maintains a high Momentum score of 98.98, although its price trend indicates caution with a positive outlook only for the long term while short and medium trends are currently marked as unfavorable.

NKTR Price Action: Nektar Therapeutics shares closed Monday lower by 7.17% at $43.48, according to Benzinga Pro data.

The current price is notably 24.2% below the recent average price, indicating that the stock has faced considerable selling pressure.

Despite this downturn, it remains 38% above its longer-term average, suggesting a potential area of support that could stabilize the price if selling continues.

Read Also:

• Gilead Sciences Bets On Weekly Pill To Tackle Genital Herpes

Image: Shutterstock

Recent Comments