Advanced Micro Devices Inc (NASDAQ:AMD) shares are edging higher in Monday morning trading following a report that Chinese tech giant Alibaba Group Holding Ltd – ADR (NYSE:BABA) is weighing a massive acquisition of AMD’s latest AI hardware. Here’s what investors need to know.

- Advanced Micro Devices stock is trading near recent highs. What’s next for AMD stock?

What To Know: According to MLex, Alibaba is considering an order of between 40,000 and 50,000 units of AMD’s MI308 AI accelerators. This development serves as a potent counter-narrative to the bearish sentiment that plagued the stock last week, specifically fears regarding China’s burgeoning domestic semiconductor independence.

Just last week, AMD stock stumbled after reports surfaced of a Chinese breakthrough in EUV lithography, which investors feared would accelerate the nation’s decoupling from Western chip suppliers.

The potential Alibaba deal emphatically challenges that thesis, signaling that top-tier Chinese hyperscalers remain dependent on superior Western silicon to fuel their immediate artificial intelligence ambitions.

Beyond the geopolitical implications, the sheer scale of the potential order validates the MI308 as a commercially viable alternative to Nvidia’s dominant H-series chips in the high-stakes data center market.

What Else: This vote of confidence from a global tech giant could alleviate lingering investor anxiety surrounding demand durability, which had been exacerbated by recent uncertainties over Oracle’s data center financing.

Coming on the heels of Micron Technology’s strong earnings report, which already began lifting the semiconductor sector late last week, this news provides the specific fundamental catalyst AMD needed to reverse its recent technical weakness.

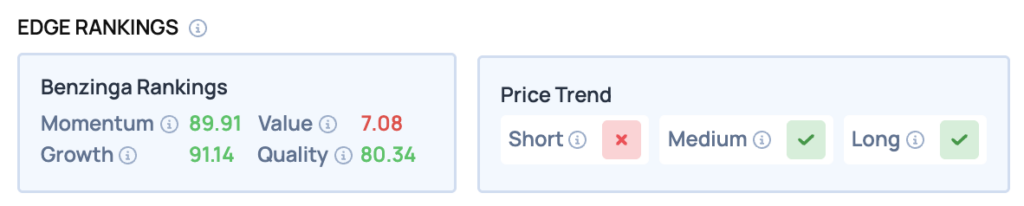

Benzinga Edge Rankings: Reinforcing this fundamental optimism, Benzinga Edge data assigns AMD a stellar Growth score of 91.14, underscoring the company’s strong trajectory despite a technically bearish short-term price trend.

AMD Price Action: Advanced Micro Devices shares were up 0.27% at $214.00 at the time of publication on Monday, according to Benzinga Pro data.

The current price is positioned 6.2% below a key resistance level, which could present challenges for upward momentum in the near term. Conversely, the stock remains significantly above its historical lows, trading 35.9% above a critical support level that has provided a solid foundation for price stability.

Technical indicators suggest that the stock may be at a crossroads. A move above the recent high could attract more buyers, while a drop below the recent low could trigger selling pressure and test the underlying support levels.

Read Also: Nvidia Shares Rise To Start The Week: What’s Going On With The AI Chip Stock?

Image: Shutterstock

Recent Comments