Conagra Brands, Inc. (NYSE:CAG) will release earnings results for its second quarter before the opening bell on Friday, Dec. 19.

Analysts expect the Chicago, Illinois-based company to report quarterly earnings at 44 cents per share, down from 70 cents per share in the year-ago period. The consensus estimate for Conagra Brands’ quarterly revenue is $2.98 billion. Last year, it reported $3.2 billion in revenue, according to Benzinga Pro.

On Oct. 1, Conagra Brands posted first-quarter fiscal 2026 results that topped Wall Street expectations but showed year-over-year declines.

Shares of Conagra Brands fell 0.7% to close at $17.80 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

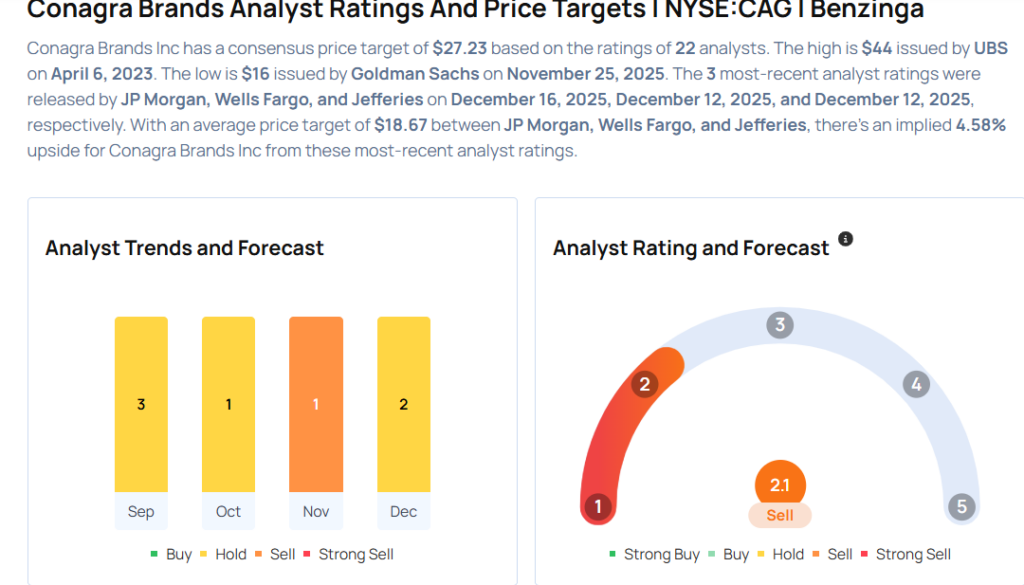

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Chris Carey maintained an Equal-Weight rating and cut the price target from $20 to $19 on Dec. 12, 2025. This analyst has an accuracy rate of 60%.

- Stifel analyst Matthew Smith maintained a Hold rating and cut the price target from $21 to $19 on Dec. 11, 2025. This analyst has an accuracy rate of 53%.

- Goldman Sachs analyst Leah Jordan maintained a Sell rating and slashed the price target from $18 to $16 on Nov. 25, 2025. This analyst has an accuracy rate of 51%.

- Evercore ISI Group analyst David Palmer maintained an In-Line rating and cut the price target from $24 to $23 on Sept. 24, 2024. This analyst has an accuracy rate of 53%.

- Morgan Stanley analyst Megan Alexander maintained an Equal-Weight rating and raised the price target from $20 to $21 on Sept. 24, 2025. This analyst has an accuracy rate of 68%

Considering buying CAG stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Recent Comments