The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Aecom (NYSE:ACM)

- On Dec. 18, Truist Securities analyst Jamie Cook maintained AECOM with a Buy and lowered the price target from $148 to $126. The company’s stock fell around 14% over the past month and has a 52-week low of $85.00.

- RSI Value: 27.4

- ACM Price Action: Shares of Aecom rose 0.6% to close at $97.31 on Thursday.

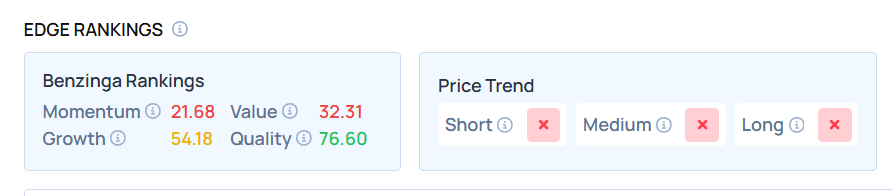

- Edge Stock Ratings: 21.68 Momentum score with Value at 32.31.

CACI International Inc (NYSE:CACI)

- On Dec. 12, Citigroup analyst John Godyn initiated coverage on CACI International with a Neutral rating and announced a price target of $642. The company’s stock fell around 9% over the past month and has a 52-week low of $318.60.

- RSI Value: 29

- CACI Price Action: Shares of CACI fell 2.1% to close at $548.96 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in CACI stock.

Generac Holdings Inc (NYSE:GNRC)

- On Dec. 8, JP Morgan analyst Mark Strouse upgraded Generac from Neutral to Overweight and maintained the price target of $200. The company’s stock fell around 18% over the past month and has a 52-week low of $99.50.

- RSI Value: 29.9

- GNRC Price Action: Shares of Generac fell 5.4% to close at $136.99 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in GNRC shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments