TikTok has reportedly signed an agreement to create a new U.S.-based joint venture with major American investors.

TikTok Reaches Binding Deal With US Investors

TikTok has signed binding agreements with a group of investors, including Oracle Corp. (NYSE:ORCL), Silver Lake and Emirati investment firm MGX, to form a new TikTok U.S. entity, reported The Associated Press, citing an internal memo.

The deal is expected to close Jan. 22.

In the memo, TikTok CEO Shou Zi Chew confirmed the agreement to employees, thanking them for navigating years of uncertainty.

See Also: Why TikTok Owner’s AI Phone Is Making China’s Apps Nervous

Ownership Structure Reduces ByteDance Control

Under the proposed structure, 50% of the new U.S. venture will be owned by a group of investors — among them, Oracle, Silver Lake and MGX will each hold 15% stakes.

ByteDance will retain a 19.9% interest, while affiliates of existing ByteDance investors will own another 30.1%, the memo said.

The company did not disclose the identities of all investors.

TikTok and the White House did not immediately respond to Benzinga’s request for comments.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

US Data, Algorithm And Governance Changes

The new entity will be governed by a seven-member board with a majority of American directors and will operate under provisions designed to “protect Americans’ data and U.S. national security.”

U.S. user data will be stored domestically on systems operated by Oracle.

The algorithm will be retrained using U.S. data to ensure content recommendations are insulated from foreign influence, while the U.S. venture will oversee content moderation and policies, the report said.

Deal Ends Years Of Regulatory Uncertainty

The agreement follows bipartisan legislation signed by former President Joe Biden that threatened to ban TikTok unless it cut ties with China-based ByteDance.

TikTok briefly went offline ahead of the January 2025 deadline before President Donald Trump issued an executive order keeping the app operational while negotiations continued.

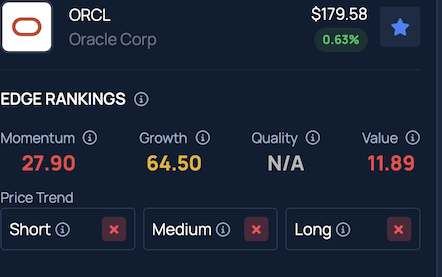

Price Action: Oracle closed Thursday at $180.03 up 0.88% and jumped to $189.68 in after-hours trading gaining or 5.36%, according to Benzinga Pro.

Benzinga Edge Stock Rankings show Oracle is facing a downward price trend across short, medium and long-term horizons, with more detailed performance insights available here.

Photo Courtesy: Eliseu Geisler on Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Recent Comments