FactSet Research Systems Inc. (NYSE:FDS) reported better-than-expected first-quarter results on Thursday.

The company posted first-quarter sales of $607.6 million, surpassing analyst expectations of $600.5 million and representing a 6.9% year-over-year (Y/Y) gain. The company reported quarterly adjusted earnings per share of $4.51, exceeding the street view of $4.37.

FactSet CEO Sanoke Viswanathan said, “FactSet’s strong start to the year underscores the quality of our data and products and the strategic role our platform and analytical services play across the financial ecosystem.”

FactSet reaffirmed its fiscal 2026 guidance, projecting adjusted EPS of $16.90–$17.60 (versus $17.38 consensus) and sales of $2.423 billion–$2.448 billion (versus $2.442 billion consensus). The company sees organic ASV of $100 million-$150 million and adjusted operating margin of 34.0% to 35.5%.

FactSet Research shares gained 4.6% to $286.00 on Friday.

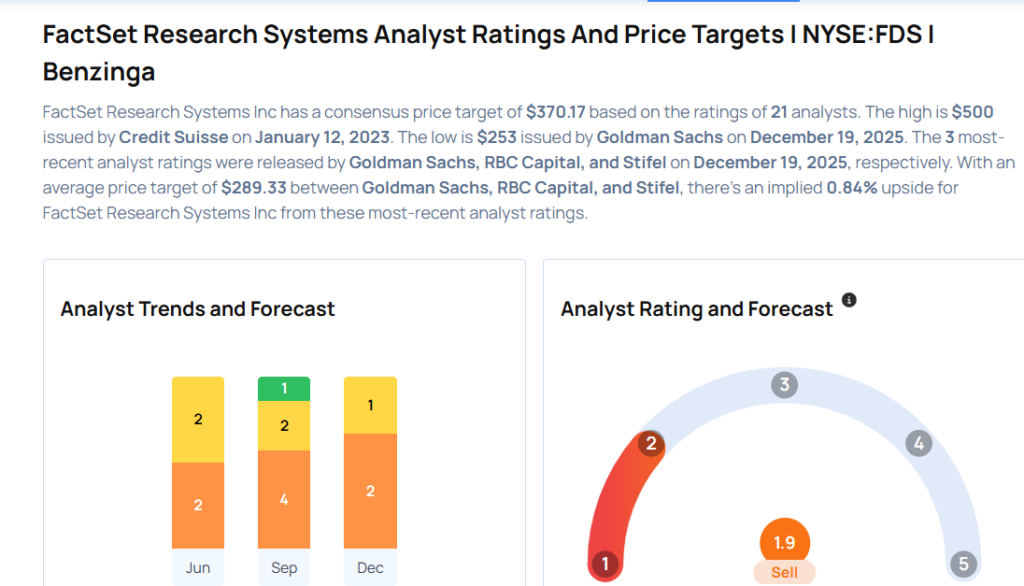

These analysts made changes to their price targets on FactSet Research following earnings announcement.

- Stifel analyst Shlomo Rosenbaum maintained FactSet Research with a Hold and lowered the price target from $372 to $295.

- Goldman Sachs analyst George Tong maintained the stock with a Sell and lowered the price target from $282 to $253.

Considering buying FDS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Recent Comments