Stock trading platform, Robinhood Markets Inc.’s (NASDAQ:HOOD) CEO, Vlad Tenev, weighed in on the growing political backlash against artificial intelligence (AI), responding directly to concerns raised by Sen. Bernie Sanders (I-VT) over the rapid expansion of AI data centers and their potential societal impact.

Bats For Retail Exposure To Private AI Companies

On Thursday, in a post on X, Tenev said that the fears surrounding AI are rooted in a growing sense of economic exclusion among everyday Americans.

Addressing Sanders’ post, he said, “This sentiment is exactly why we need to work to give retail investors exposure to private AI companies,” as many leading AI companies with soaring valuations, such as ChatGPT parent OpenAI and PerplexityAI, continue to remain privately held, and thus, off-limits for retail investors.

“People worry AI will take their jobs and give them nothing back,” Tenev said. “If we don’t act accordingly, they will push back harder and harder against AI acceleration.”

“Give them a stake in the leading AI companies, and they’ll become supporters and defenders,” he said, adding that the crypto industry has done a much better job in this regard.

Robinhood To Offer Retail Investors Stake In Private AI Companies

Last month, Robinhood announced that it plans to launch a new fund, managed by its subsidiary Robinhood Ventures, which will allow retail traders and investors to gain exposure to a concentrated portfolio of “best in class” private AI companies.

Beyond just AI, Robinhood has consistently championed the tokenization of private company shares to expand retail access to high-growth firms like SpaceX, Stripe, and Databricks, names that remain out of reach for most individual investors under the current system.

Tenev has said that the technology for such tokenization is already in place, adding, “What’s needed is comprehensive securities legislation,” since the current accredited investor rules “shut out north of 80% of the public currently.”

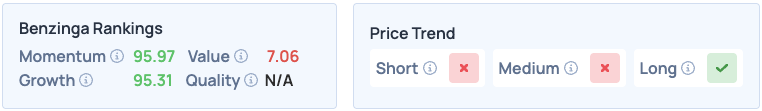

Shares of Robinhood were up 1.17% on Thursday, closing at $117.16, and are up 2.45% overnight. The stock scores high on Momentum and Growth in Benzinga’s Edge Stock Rankings, with a favorable price trend in the long term. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Sergei Elagin On Shutterstock.com

Recent Comments