Weight loss drug Mounjaro’s manufacturer, Eli Lilly and Co. (NYSE:LLY) has crossed a significant threshold in Benzinga Edge’s Stock Rankings, moving into the top decile for quality this week. This improvement in fundamental strength coincides with a bullish note from Bank of America, which argues the market is still underestimating the pharmaceutical giant’s dominance in the obesity sector.

Check out LLY’s price here.

Entering The Top Decile

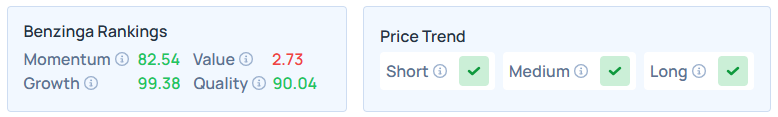

In the latest weekly data update, Eli Lilly’s quality score advanced from 89.66 to 90.04. This uptick pushes the stock into the “elite” tier of the market, ranking it higher than 90% of its peers.

According to Benzinga’s ranking methodology, the quality metric is a composite score that evaluates a company’s “operational efficiency and financial health” by analyzing historical profitability and fundamental indicators.

This improvement complements the stock’s near-perfect growth score of 99.38, highlighting a rare combination of rapid expansion and operational stability.

Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

See Also: Warren Buffett’s Homebuilder Bet Lennar Slides In Quality Ranking After Mixed Q4

Analyst Sees Undervalued Growth

The improvement in financial health metrics aligns with Bank of America’s assessment that Lilly’s long-term value is not fully priced in. Analyst Jason Gerberry recently reiterated a Buy rating, noting that while the company is already a leader in injectable GLP-1s like Zepbound, the market is “under-calling” the potential of its next phase.

Gerberry said there remains “room for stock upside” as Lilly continues to execute on key obesity launches and de-risk new therapies across “nearly every conceivable market segment.”

Specifically, BofA points to the 2026 launch of Orforglipron, Lilly’s oral weight-loss pill. While the consensus estimates for the drug sit near $1 billion, Bank of America forecasts $3 billion in revenue for 2026, driven by the drug’s ease of use and global scalability compared to injectable alternatives.

Pipeline Solidity

Lilly further solidified its quality narrative on Thursday with positive Phase 3 data for Orforglipron. The ATTAIN-MAINTAIN trial showed that the oral pill successfully helped patients maintain weight loss after switching from injectable treatments like Wegovy and Zepbound.

By securing a viable maintenance option, Lilly is effectively de-risking its future revenue streams—a key factor driving its improving financial health scores.

LLY Price Action: The stock was 0.10% higher in premarket on Friday after closing 1.45% higher at $1,056.88 apiece on Thursday. It has advanced 35.83% year-to-date and 38.57% over the last six months.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments