Billionaire entrepreneur and Tesla Inc. (NASDAQ:TSLA) CEO, Elon Musk, weighed in on a post praising Google-parent Alphabet Inc.’s (NASDAQ:GOOG) new hardware play, and the company’s reemergence as the dominant player in the ongoing AI race.

Long-Time Google Critic Turns Investor

On Thursday, in a post on X, serial AI entrepreneur and digital nomad Pieter Levels, who goes by the name Levelsio, announced that he had purchased over $1 million in Alphabet shares, after being “the biggest Google hater for years.”

Levels said the company had been “completely mismanaged” for years and was “destroyed by politics and lack of any leadership,” before undergoing a turnaround that he attributed to the return of co-founder Sergey Brin, whom he described as the “de facto CEO.”

According to Levels, Google is now “dominating not just in the AI benchmarks and leaderboards but in real usage,” while pointing out that “AI benchmarks can, and are easily rigged.”

He pointed to Google’s proprietary tensor processing units, massive data advantages through YouTube, Google Images and web search, and what he described as renewed engineering leadership under Brin for his investment decision, and why he thinks the company is now set to lead the AI race.

“It’s really just Google and Elon Musk and the Chinese in the end who will probably win,” Levels said, adding that he only relies on models from Google, Musk’s xAI, and Chinese firms such as ByteDance, Kling and Minimax.

Levels, the founder of PhotoAI, InteriorAI and RemoteOK, also said that he had trimmed his holdings in NVIDIA Corp. (NASDAQ:NVDA) months earlier, noting that competition in AI chips was “inevitable,” with Google’s TPUs now offering a credible alternative.

Hardware Is ‘The End Game,’ Says Musk

Musk responded Levels’ post on X with a single line, saying, “Hardware is the end game.” This comes amid Tesla’s growing in-house AI chip program, which Musk plans to scale going forward.

“We expect to build chips at higher volumes ultimately than all other AI chips combined. Read that sentence again, as I’m not kidding,” Musk said last month.

Senior Wedbush analyst Dan Ives has labeled Tesla one of the market’s leading “physical AI plays,” citing the company’s push to translate AI into physical systems, such as with its autonomous vehicles, robotaxis and even the Optimus humanoid robots.

Shares of Google were up 1.91% on Thursday, closing at $303.75, and are up 0.47% overnight, while Tesla is up 3.45%, at $483.37, and up 0.43% overnight.

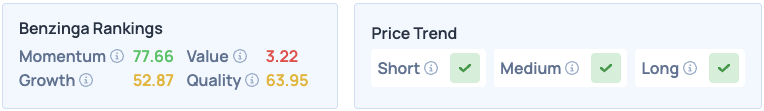

Tesla shares score high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here to see how it compares with Google, along with its other peers and competitors.

Read More:

Photo Courtesy: Photo Agency on Shutterstock.com

Recent Comments