Micron Technology Inc. (NASDAQ:MU) reported better-than-expected earnings for the first quarter of fiscal 2026 and issued a strong outlook for the second quarter on Wednesday.

Micron reported first-quarter revenue of $13.64 billion, topping analyst estimates of $12.83 billion, according to Benzinga Pro. The chip company posted adjusted earnings of $4.78 per share for the quarter, exceeding analyst estimates of $3.95 per share.

“In fiscal Q1, Micron delivered record revenue and significant margin expansion at the company level and also in each of our business units,” said Sanjay Mehrotra, chairman, president and CEO of Micron.

Micron sees second-quarter revenue of $18.7 billion, plus or minus $400 million, versus estimates of $14.16 billion. The company anticipates second-quarter adjusted earnings of $8.42 per share, plus or minus 20 cents.

Micron shares jumped 11.4% to trade at $251.54 on Thursday.

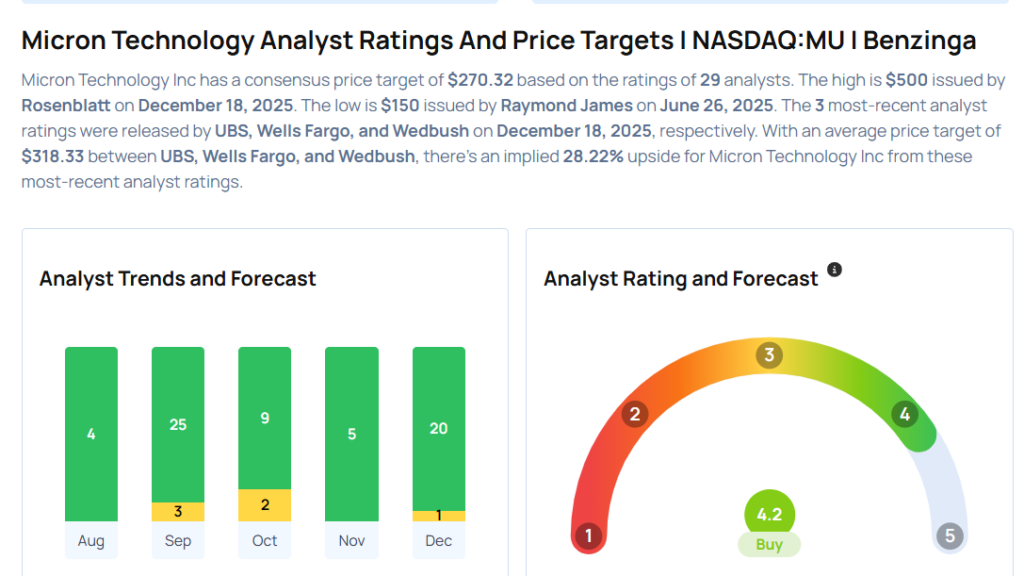

These analysts made changes to their price targets on Micron following earnings announcement.

- B of A Securities analyst Vivek Arya upgraded Micron from Neutral to Buy and raised the price target from $250 to $300.

- Rosenblatt analyst Kevin Cassidy maintained the stock with a Buy and raised the price target from $300 to $500.

- Mizuho analyst Vijay Rakesh maintained Micron with an Outperform rating and raised the price target from $270 to $290.

- Piper Sandler analyst Harsh Kumar maintained the stock with an Overweight rating and raised the price target from $200 to $275.

- Raymond James analyst Melissa Fairbanks maintained Micron with an Outperform rating and raised the price target from $190 to $310.

- Morgan Stanley analyst Joseph Moore maintained the stock with an Overweight rating and raised the price target from $338 to $350.

- Keybanc analyst John Vinh maintained the stock with an Overweight rating and raised the price target from $215 to $325.

- Cantor Fitzgerald analyst C.J. Muse maintained Micron with an Overweight rating and raised the price target from $300 to $350.

- Wedbush analyst Matt Bryson maintained Micron with an Outperform rating and raised the price target from $300 to $320.

- Wells Fargo analyst Aaron Rakers maintained Micron with an Overweight rating and raised the price target from $300 to $335.

- UBS analyst Timothy Arcuri maintained the stock with a Buy and raised the price target from $295 to $300.

Considering buying MU stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Recent Comments