The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Noah Holdings Limited (NYSE:NOAH)

- On Nov. 25, Noah Holdings posted upbeat quarterly sales. Ms. Jingbo Wang, Co-founder and Chairwoman of Noah, said, “We are pleased to report strong growth in profitability during the third quarter as we continue to build on the strong momentum from the previous period. While net revenues increased slightly on a sequential basis to RMB632.9 million, non-GAAP net income grew significantly to RMB229.1 million, a robust 52.2% year-over-year increase.” The company’s stock fell around 10% over the past month and has a 52-week low of $7.67.

- RSI Value: 26.1

- NOAH Price Action: Shares of Noah Holdings fell 1% to close at $9.64 on Tuesday.

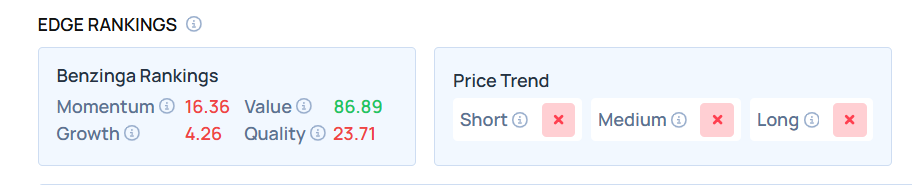

- Edge Stock Ratings: 16.36 Momentum score with Value at 86.89.

Ready Capital Corp (NYSE:RC)

- On Nov. 6, Ready Capital posted weaker-than-expected third-quarter results. “Our primary focus continues to be restoring financial health,” said Thomas Capasse, Ready Capital’s Chairman and Chief Executive Officer. “Through our decisive exit strategies for our underperforming loan and real estate exposure and risk management of our upcoming debt maturities, we believe we are on the path to balance sheet stability and profitability.” The company’s stock fell around 12% over the past month and has a 52-week low of $2.13.

- RSI Value: 26.1

- RC Price Action: Shares of Ready Capital fell 4.7% to close at $2.22 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in RC stock.

X Financial (NYSE:XYF)

- On Nov. 20, the company posted third-quarter total net revenue of $275.5 million (RMB1,961.0 million), up 23.9% year-over-year, but lower by 13.7% quarter-over-quarter. “Q3 reflected a more challenging operating environment,” said Kent Li, President of X Financial. “Loan origination declined from Q2 highs, borrower activity moderated, and delinquency rates increased across key categories. While profitability came under pressure from higher provisions and rising operating costs, we continue to prioritize risk control, collection efficiency, and disciplined execution. Our focus remains on maintaining credit quality, liquidity stability, and long-term competitiveness amid shifting market and regulatory conditions.” The company’s stock fell around 41% over the past month and has a 52-week low of $6.47.

- RSI Value: 25.2

- XYF Price Action: Shares of X Financial fell 3.6% to close at $6.63 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in XYF shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments