Alphabet Inc.’s (NASDAQ:GOOG) (NASDAQ:GOOGL) autonomous driving unit, Waymo, is reportedly in talks to raise more than $10 billion.

Waymo Reportedly Plans Massive Capital Raise

Waymo, the self-driving car subsidiary of Alphabet, is in discussions about a major funding round that could value the company at $100 billion or more, reported Reuters (via The Information).

The financing could exceed $10 billion and is expected to be organized early next year, the report said, citing people familiar with the matter.

Bloomberg News separately reported that Waymo may seek more than $15 billion in fresh capital at a valuation near $100 billion, with Alphabet expected to lead the round.

Alphabet and Waymo did not immediately respond to Benzinga’s request for comments.

Waymo’s Lead In Fully Driverless Robotaxis: Gerber

Spun out of Google’s self-driving car project in 2016, Waymo was praised as a leader in the robotaxi space by Ross Gerber, co-founder of investment firm Gerber Kawasaki, last month.

Gerber said Waymo is “well ahead” of competitors and continues to extend its lead each week.

Notably, Waymo’s robotaxis are operating on highways without onboard safety drivers.

On Sunday, Waymo-rival Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk said that the electric-vehicle maker is testing its robotaxis without safety monitors seated in the front passenger seat.

Tesla has a market cap of $1.54 trillion, while Alphabet has a market value of about $3.7 trillion.

Waymo Tops 1 Million Monthly Driverless Rides

Last week, Waymo said it has been providing more than 1 million fully driverless rides per month since the spring and aims to reach that volume on a weekly basis by the end of 2026.

The company added that it has completed 14 million trips so far in 2025—more than triple last year’s total—and expects lifetime rides to exceed 20 million by the end of the year.

Price Action: Alphabet Inc.’s Class A shares slipped 0.33% in after-hours trading while Class C shares were down 0.30%, according to Benzinga Pro.

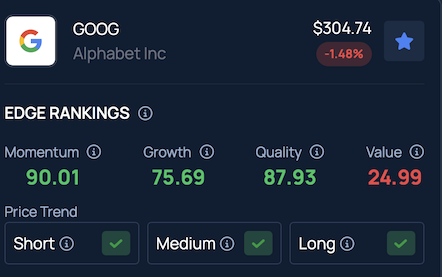

GOOG is also demonstrating a strong price trend across the short, medium and long-term time frames. For more detailed insights, visit Benzinga Edge Stock Rankings.

Read Next:

Image via Shutterstock/ Sundry Photography

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments