Investor Martin Shkreli, popularly referred to as the “Pharma Bro,” released the traffic data of leading AI websites while highlighting the stark disparities in the usage of popular chatbots.

ChatGPT, Gemini Lead The Charge

On Tuesday, in a post on X, Shkreli said, “55 billion minutes” were spent on leading AI sites last month, while adding that OpenAI’s ChatGPT and Alphabet Inc.’s (NASDAQ:GOOG) Gemini dominated on traffic and engagement, making up 64% and 15% of total user minutes, respectively.

Without specifying any sources for this data, Shkreli’s post is accompanied with a table listing all major AI sites, with their respective user minutes in millions, during November 2025, alongside their market share and year-over-year growth.

Shkreli noted that among the big AI websites, only China’s Deepseek and xAI’s Grok are on a trajectory that “come even close” to the big two, in terms of traffic and engagement, with a year-over-year growth of 7,725% and 23,300%, respectively.

Users have since commented on Shkreli’s post, noting that user minutes alone cannot determine the success of leading AI chatbots.

This includes biotech investor Peter Suzman, who called Shkreli’s list “deceptive,” since companies like Amazon.com Inc.-backed (NASDAQ:AMZN) Anthropic are more focused on “revenue-producing corporate users,” instead of being consumer-focused like ChatGPT.

He also added that Anthropic’s Claude AI is “by all accounts well ahead in the programming race,” and thus cannot be judged based on visits and user minutes alone.

Google Gaining Ground On OpenAI

There has been a stunning reversal in the hierarchy of AI models in recent weeks, as the growing popularity of Google’s Gemini 3, which was released on November 18, triggered alarms at OpenAI.

The company behind ChatGPT was reportedly forced to abandon its monetization roadmap, which included search ads, agentic shopping features, and more, refocusing its efforts on dealing with quality issues and retaining its massive user base instead.

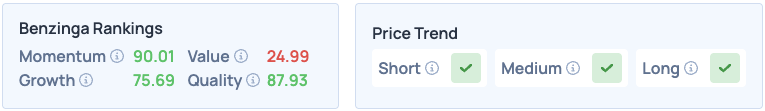

Shares of Alphabet were down 0.51% on Tuesday, closing at $307.73, and are up 0.07% overnight. The stock scores high on Momentum, Growth and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo Courtesy: Koshiro K on Shutterstock.com

Recent Comments