Donald Trump’s son-in-law, Jared Kushner’s private equity firm, Affinity Partners, is reportedly exiting the battle to acquire Warner Bros. Discovery (NASDAQ:WBD).

Affinity Partners Exits Paramount-Backed Bid

Earlier this month, Paramount Skydance Corp (NASDAQ:PSKY) launched a hostile $108 billion bid for Warner Bros. Discovery. They used backing from Affinity Partners and Middle Eastern sovereign wealth funds.

However, now, Affinity Partners has decided to withdraw its support, reported Bloomberg on Tuesday, citing an Affinity spokesperson saying that they still think Paramount has a strong case.

See Also: Elon Musk Prepares SpaceX IPO Valued At More Than RTX, Boeing, Lockheed Combined

Paramount has valued Warner Bros. at about $108.4 billion, including debt. The company is attempting to block Netflix Inc.’s (NASDAQ:NFLX) $82.7 billion merger deal with Warner Bros.

Meanwhile, Warner Bros.’ board has reportedly decided to urge shareholders to reject Paramount’s offer.

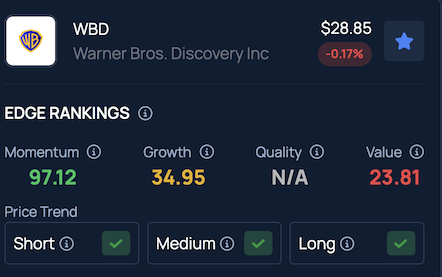

According to Benzinga’s Edge Stock Rankings, WBD shows a strong price trend across short, medium and long-term periods. More performance insights can be found here.

Read Next:

Photo Courtesy: Alexandros Michailidis on Shutterstock.com

Recent Comments