Despite recent market jitters sparked by precipitous stock drops in high-flying firms like CoreWeave Inc. (NASDAQ:CRWV), Goldman Sachs Asset Management believes the broader artificial intelligence (AI) trade remains structurally sound.

The 90/10 Funding Reality

Sung Cho, co-head of public tech investing, argues that fears of a debt-fueled bubble are misplaced because the vast majority of the sector’s massive infrastructure buildout is funded by robust corporate cash flows, not risky borrowing.

In an interview with CNBC, Cho acknowledged the market is currently fixated on “debt depreciation and doubts,” but insisted the underlying funding picture through 2026 is healthy.

He estimates the industry needs between $700 billion and $1 trillion for AI infrastructure over the next couple of years.

Crucially, Cho noted that fears of overleverage are exaggerated. “You fear that 90% of that is being funded by debt,” Cho said, correcting that misperception by stating, “It’s really only 10% that’s being funded by debt. 90% is funded by operating cash flows.”

He pointed out that major players like Meta Platforms Inc. (NASDAQ:META) hold credit ratings superior to the U.S. government, further stabilizing the market’s core.

Isolating ‘Tail’ Risks

The recent collapse in shares of CoreWeave—labeled a “staggering fall from grace” during the broadcast—along with concerns surrounding Oracle Corp. (NASDAQ:ORCL), are outliers rather than systemic indicators, according to Goldman.

Cho described these situations as “tails” constituting perhaps only 2-3% of the entire debt funding picture.

Furthermore, he argued that these specific companies aren’t facing a demand issue, but rather supply chain backups that are hindering their deployment.

See Also: Nvidia’s Depreciation Time Bomb: Jim Chanos Warns Of ‘Massive Financial Risk’ For CoreWeave, Oracle

Shift In AI Leadership

Beyond funding mechanics, Cho highlighted significant shifts in investor sentiment regarding AI leadership.

While Meta and subsequently OpenAI were previously viewed as dominant, investors currently see Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) Gemini as the leading frontier model.

This perception has helped drive a $1 trillion market cap gain for Google over the last three months, though Cho warned that such “model volatility” among top players is likely to persist.

CRWV Drops Over 20% In Last 5 Sessions

CRWV shares fell 3.94% to $69.50 apiece on Tuesday, and it has declined 23.34% over the last five sessions. However, it was up by 78.21% since listing earlier this year.

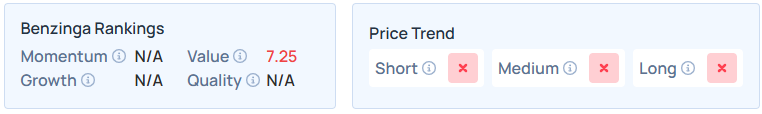

It maintains a weaker price trend over the short, medium and long term, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: T. Schneider / Shutterstock

Recent Comments