Accenture plc (NYSE:ACN) heads into Thursday’s earnings with its share price down roughly 22% this year, as slowing contract momentum and macro uncertainty have overshadowed what management pitches as strong AI-enabled growth opportunities.

For traders, the question is no longer whether Accenture can beat on earnings— but whether guidance and bookings can offset the impact of government austerity and competition from its cloud rivals.

What To Watch In Q1 Print

Wall Street is forecasting $3.72 per share on revenue of $18.53 billion, according to data from Benzinga Pro.

The Dublin-based company has beaten consensus EPS in multiple recent quarters, yet the stock has often sold off because new bookings, a closely watched metric that reflects clients’ willingness to commit to future spending, have been weak.

The slowdown has stoked fears of weaker discretionary spending, potential U.S. federal contract cuts and rising competition from cloud hyperscalers. U.S. federal government business makes up about 8% of Accenture’s global revenue.

Analysts will also dissect any guidance updates for fiscal 2026, particularly given previous management commentary highlighting moderated revenue growth expectations of 2–5%.

AI Hype Vs. Reality As Investments Ramp Up

Accenture’s pivot to AI has been a highlight, with generative AI bookings scaling rapidly from minimal levels to a multi-billion-dollar run rate, but this still represents only a fraction of total bookings, leaving investors debating how soon this will meaningfully offset weaker traditional demand.

Of $80.6 billion in total new bookings for the year ended Aug. 31, only $5.9 billion came from generative AI.

The company is also undergoing an $865 million restructuring program to realign its workforce and operations for rising demand in digital and AI services.

Accenture has ramped up its AI push, announcing on Tuesday it will acquire a majority stake in AI data center firm DLB Associates and form a new joint business group with Palantir Technologies (NASDAQ:PLTR), naming Accenture as Palantir’s preferred global partner for large-scale enterprise AI deployments.

Earlier this month, the company launched a multi-year partnership with Amazon-backed Anthropic to train about 30,000 professionals, and struck a deal with OpenAI to roll out agentic AI systems and ChatGPT Enterprise across its consulting and operations workforce.

Stock Under Pressure

Still, over the past 12 months, the stock has declined by 23.86%, compared with rival IBM’s (NYSE:IBM) 32.41% surge in the same period and Technology Select Sector SPDR Fund’s (NYSE:XLK) 18% increase.

On Tuesday, Accenture’s shares closed down nearly 1% at $272.04.

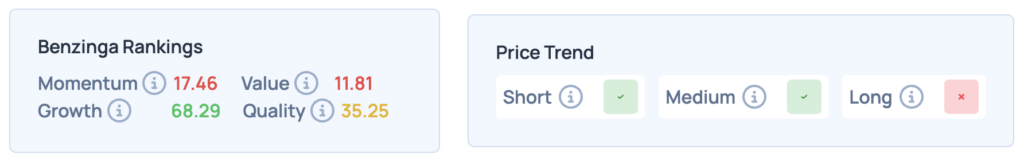

Benzinga’s proprietary Edge Rankings show Growth as the strongest category for ACN. To see how the stock ranks for Value, Growth and Momentum, click here.

Accenture reports fiscal 2026 Q1 results before markets open on Dec. 18, Thursday.

READ NEXT:

Image via Shutterstock

Recent Comments